The Companies Act of 2013’s Chapter XIV explains how to inspect, inquire into, and investigate Companies. The purpose of this chapter is to include measures that would deal with examining how the companies operate to make sure there are no violations or unlawful actions. Sections 206 to 208 of Chapter IV, which can be split into two Sections, deal with the examination of books and the conduct of inquiries. The company’s shareholders, who have the authority to control the company’s business, elect the management. However, directors or executives of the firm can also occasionally misuse their positions of authority, which might result in the loss of stakeholders.

As a result, it was essential for the Indian government to acquire certain powers to ensure that it could inspect, inquire into, and investigate the affairs of these companies when there is cause to suspect that the company’s activities are being carried out with the intent of defrauding its creditors or members or for another fraudulent or illegal reason.

What does inquiry mean?

In order to discover a solution to the issue, it is a procedure that involves questioning and interrogation via analyzing and questioning. This is the procedure to provide clarification or dispel any confusion regarding any issue. This helps in clearing the doubts related to the main matter of the subject.

What is investigation?

An investigation is a thorough accounting analysis and inquiry into the company’s current condition of affairs or for a particular goal. It comprises the process of gathering, compiling, and presenting data in a way that enables the parties to comprehend the crucial details about the investigation’s focus.

Section 206 of the Companies Act

According to Sub-Section (1) of Section 206 of Companies Act 2013, the registrar may, by written notice, order the company to either provide in writing the relevant document or clarification, or produce such record or justification within either an acceptable period or as may be stated in the notice, if he is of the view that any further explanation, information, or any document is required after reviewing any document filed by a company, or if he is of the opinion that any information received by him, is required. The right to notify should not be used carelessly or frequently, the courts have repeatedly emphasized this. According to the Registrar, there must be cause for concern with the supporting evidence or explanations.

It is the responsibility of the company and all of its officials, past and presents that upon the receipt of a notice received from the registrar according to Section 206 (1), to provide such information or explanation that is relevant to the fullest of their abilities and knowledge within the time period indicated in the notice.

If no information or an explanation is provided to the Registrar within the time frame required by Sub-section (1) of Section 206 of Companies Act, 2013, if the Registrar determines from a review of the documents provided that the information or explanation provided is insufficient, or if the Registrar determines from a review of the documents provided that the company is in an unsatisfactory state of affairs and has not provided a full and fair statement of the information required. [Sub-section (6) of Section 206 of Companies Act, 2013]

Before conducting any further investigation, the Registrar must notify a business of the complaints made, according to Section 206 of Companies act, 2013, sub-section (4). These regulations serve as checkpoints in a structure of checks and balances. According to the principles of natural justice, the Registrar must provide the central government with a report after each action, whether it be issuing a notice to a corporation or recommending additional inquiry.

Additionally, the registrar must do his investigations after giving the company a fair chance to be heard. Such an opportunity must be authentic and true, and it must reiterate the commitment to upholding the natural justice principles.

The central government has broad authority to order the inspection of books and files under sub-section (5) of section 206 of Companies Act, 2013. Additionally, if the Central Government “is satisfied that the current circumstances so warrant, such an examination may be started. Any statutory authority may be given permission by the central government to examine the financial records of any firm or group of companies.

The Registrar may request that the corporate furnish any information or explanation on matters set forth in the order in writing within the time period he may specify therein based on information at his disposal, representations made to him, or a complaint from shareholders that has not been addressed. The Registrar may also undertake any inquiry he deems necessary after giving the company a reasonable opportunity to be heard.

If in default, the Company and each of its officers will be subject to a punishment that could reach one lakh rupees, as well as a further fine that could reach 500 rupees each day if the failure continues. [Sub-section (7) of Section 206 of Companies Act, 2013]

Data by Ministry of Corporate Affairs in relation to inspection, inquiry and scrutiny reports

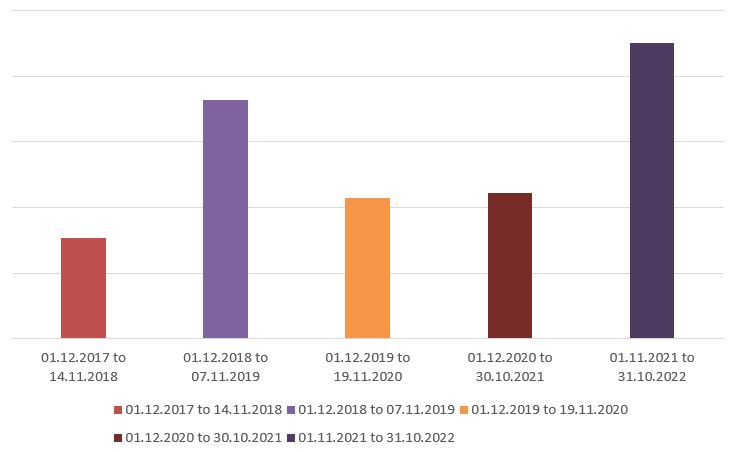

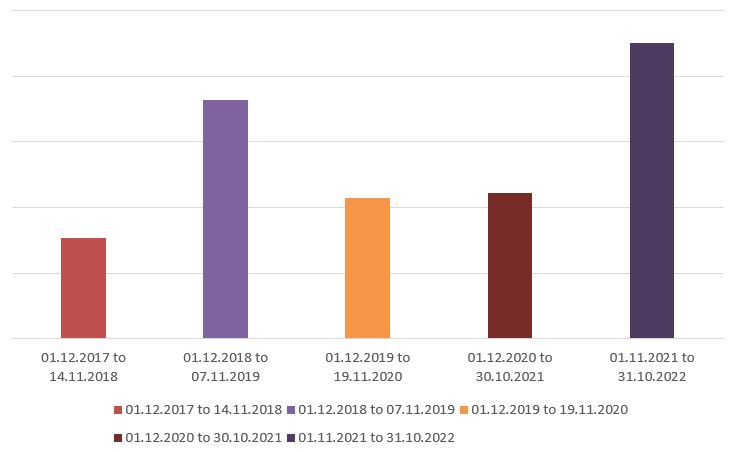

Number of Inspection reports received in the Ministry during 2017-18 to 2021-22*

| Year | Number of reports |

| 01.12.2017 to 14.11.2018 | 77 |

| 01.12.2018 to 07.11.2019 | 182 |

| 01.12.2019 to 19.11.2020 | 107 |

| 01.12.2020 to 30.10.2021 | 111 |

| 01.11.2021 to 31.10.2022 | 225 |

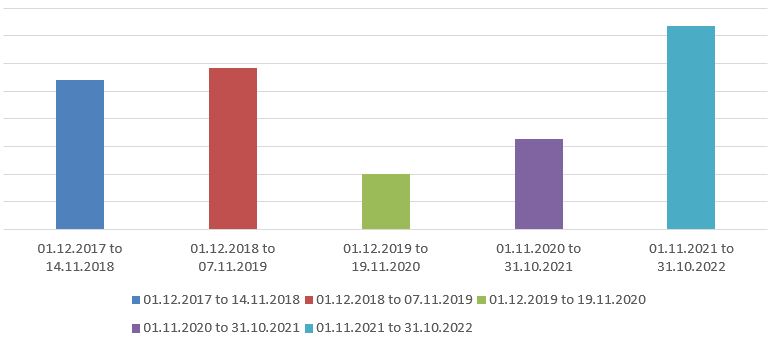

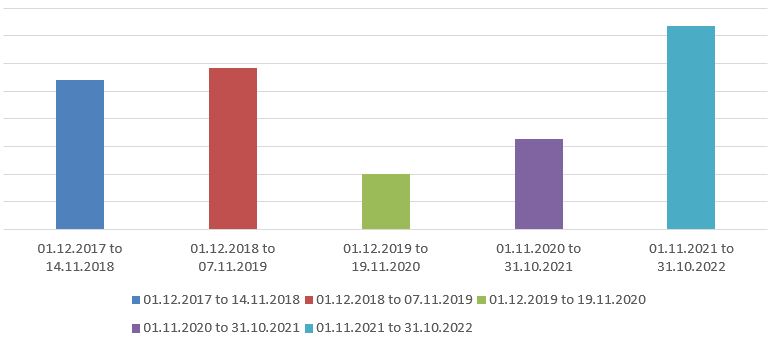

Number of Scrutiny/ Inquiry report received in the Ministry during 2017-18 to 2021-22*

| Year | Number of reports |

| 01.12.2017 to 14.11.2018 | 541 |

| 01.12.2018 to 07.11.2019 | 583 |

| 01.12.2019 to 19.11.2020 | 199 |

| 01.11.2020 to 31.10.2021 | 328 |

| 01.11.2021 to 31.10.2022 | 735 |

Conclusion

In conclusion Section 206 of Companies Act is a very crucial Section of the Companies Act, 2013. The registrar here in this Section has the power to call for information, inspect the books of the company and also in relation to conducting the inquiries. But this power cannot be used very freely, it should be used to the limit specified, and these kinds of investigations and inquiries should not be conducted on a daily basis. Only when there is solid evidence or suspicion in those circumstances should these steps be taken. The need of checks and balances is very well recognized by the Companies Act, 2013, hence these kinds of Section fulfill the purpose for which they were enacted.

Frequently Asked Questions

Section 206 of the Companies Act, 2013 gives the power to call for information, inspect books of the company and conduct inquiries.

According to Subsection (7) of Section 206 of the Companies Act of 2013, if in default, the Company and each of its officials might face fines of up to one lakh rupees as well as further penalties of up to 500 rupees per day if the failure persists.

The laws relating to Inspection, Inquiry, and Investigation of Company Affairs are covered in Sections 206 to 229 of Chapter XIV of the Companies Act, 2013. A deeper investigation into a company’s affairs is an investigation within the meaning of the applicable provisions of the Act.

The Registrar may request information or documentation from any company in accordance with Section 206 of the 2013 Companies Act if, after carefully reviewing any document or after obtaining any information, he determines that such documentation is required.

The provisions pertaining to inspection are found in Sections 206(5) and (6) of the Companies Act, 2013. A firm or class of companies’ books of accounts may be subject to inspection by any statutory authority, by general or particular order from the Central Government, depending on the circumstances.

Any government officer can inspect the register and the documents which are filed at the office of the register.

An investigation is a detailed accounting review and inquiry into the current state of affairs at a firm or for a specific objective. It entails the process of accumulating, organizing, and presenting data in such a way that it enables the parties to understand the key information regarding the investigation’s subject, while inspection means to carefully scrutinize something.

Read Our Article: Section 380 of Companies Act, 2013