The Companies Act, 2013, is a comprehensive and significant piece of legislation governing the formation, operation, and management of companies in India. It replaced the Companies Act, 1956, and was enacted to modernize and align corporate laws with international best practices, enhance transparency, and improve corporate governance. The Companies Act of 2013, a product of parliamentary approval and the President of India’s endorsement on August 29, 2013, stands as a remarkable milestone in India’s corporate legal framework. This legislation represents a comprehensive endeavour to consolidate and modernize existing laws governing companies, aligning them with current business norms and regulatory demands.

The Companies Act 2013 is an Act of the Parliament of India, comprising 29 chapters with a total of 470 sections and incorporating 7 schedules. Its primary purpose is to comprehensively regulate the functioning of companies operating within India. This landmark legislation, which came into effect on April 1, 2014, marks a substantial overhaul of the regulatory framework governing companies, introducing a wide range of provisions that define their operations, rights, and responsibilities concerning various stakeholders.

In this blog, we’ll delve into the key aspects of Section 167 of the Companies Acts, unravelling the implications it holds for directors and the companies that they serve.

Section 167 of the Companies Act 2013

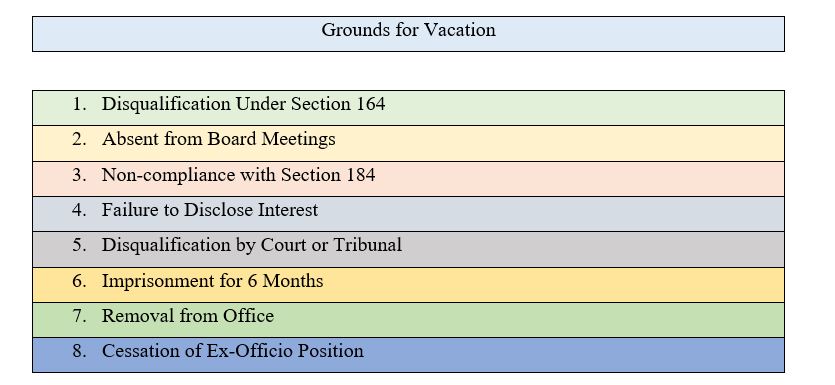

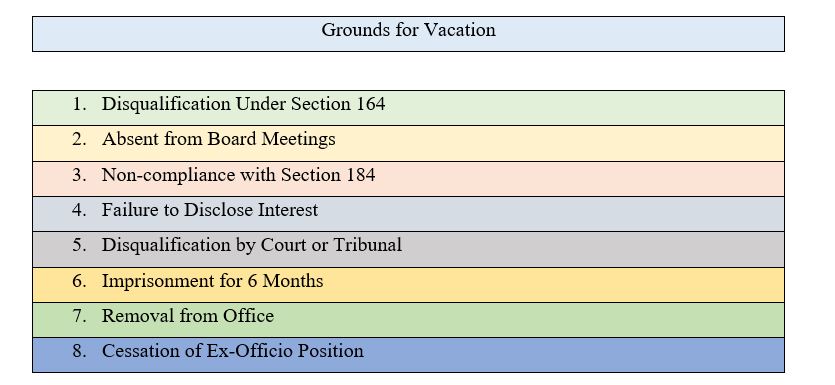

Circumstances Leading to the Vacancy of Director’s Office under Section 167

The Companies Act of 2013 serves as the legal framework governing the establishment, operation, and management of companies in India. Like a guiding blueprint for building a robust corporate structure, this act outlines the rules and regulations that shape a company’s organizational structure, conduct, and governance. One critical aspect of the Companies Act, 2013, is the provision in sub-section (1) of Section 167 of the Companies Act that applies to both public and private companies. This section delineates the scenarios under which a director’s office becomes vacant. Let’s explore these circumstances:

- Disqualification Under Section 164:

Directors who fall under any of the disqualifications listed in Section 164 of the Companies Act, 2013, are required to vacate their office. These disqualifications are essential to ensure that directors meet specific eligibility criteria.

- Absent from Board Meetings:

Active participation in board meetings is a fundamental responsibility of directors. If a director is absent from all board meetings for a continuous period of 12 months, with or without seeking leave of absence, they are obliged to vacate their office.

- Non-compliance with Section 184:

Directors must adhere to Section 184, which governs their involvement in contracts or arrangements in which they have a direct or indirect interest. Failure to comply with this provision can lead to the director vacating their office.

- Failure to Disclose Interest:

Directors are required to disclose any interest they have in contracts or arrangements. If they fail to make these disclosures as specified in Section184, they risk vacating their office.

- Disqualification by Court or Tribunal:

Directors can also be disqualified by a court or tribunal, as detailed in Section 164(1)(e). However, this provision is somewhat duplicative due to clause (a) mentioned earlier.

- Imprisonment for 6 Months:

A director convicted of any offense, whether it involves moral turpitude or not, resulting in a prison sentence of at least 6 months, must vacate their office. Even if an appeal is filed against the court’s decision, this provision applies.

- Removal from Office:

Section 169 outlines the procedures for removing directors. If a director is removed in accordance with these procedures, they are required to vacate their office.

- Cessation of Ex-Officio Position:

Directors appointed based on their position or employment in a holding, subsidiary, or associate company must vacate their office if they cease to hold such a position or employment.

Vacation of Small Shareholder Directorship:

Rule 7(7)(b) of the Companies (Appointment and Qualification of Directors) Rules, 2014, stipulates that if a person is appointed as a small shareholders’ director, they will vacate the office if it becomes vacant in accordance with the provisions outlined in Section 167 of Companies Act, 2013

Termination of Directorship in a Private Company:

Sub-section (4) of Section 167 of the Companies Act, 2013, empowers a private company to include additional grounds for the vacation of a director’s office in its articles of association, beyond the eight clauses specified in Section 167(1). In essence, private companies have the flexibility to establish custom criteria for director office termination, supplementing the standard provisions outlined in sub-section (1) of Section 167 of the Companies Act.

Penalties for Continued Directorship When Disqualified

When an individual persists in holding the office of a director despite being aware of their disqualification, legal consequences are imposed to deter such actions and maintain the integrity of corporate governance. The penalties for this offense can include:

Imprisonment for up to one year

The offender may be sentenced to serve a jail term lasting a maximum of one year. This punitive measure holds them accountable for their actions and serves as a deterrent against future violations.

A fine ranging from ₹1,00,000 to ₹5,00,000

In addition to or in place of imprisonment, a fine can be imposed on the individual. The specific amount within the range of ₹1,00,000 to ₹5,00,000 is determined based on the severity of the violation and at the discretion of the court. Fines act as a financial penalty, both as a punishment and as compensation for any harm caused.

Both imprisonment and a fine

The court has the authority to levy both imprisonment and a fine, which means the individual may serve a jail sentence and pay a monetary penalty concurrently. This dual punishment underscores the gravity of the offense and serves as a comprehensive deterrent against violations of directorship regulations.

In essence, these penalties are essential to uphold the standards of corporate governance and ensure that individuals occupying director positions do so in strict compliance with the law. They send a clear message that knowingly continuing in the role of a director while disqualified can result in both personal and financial consequences.

Appointment of Directors When All Directors Vacate Their Positions

In the scenario where all directors of a company are required to leave their roles due to specified disqualifications, the responsibility of appointing the necessary number of directors lies with the company’s promoter or, in the absence of promoters, the Central government. These appointed directors, however, are authorized to hold their positions only until new directors are officially designated through a general board meeting of the company.

Additional Insights:

Compensation Restrictions for Vacated Directorships [Section 202(2)(c)]

It’s important to note that as per Section 202(2)(c) of the Companies Act, 2013, no compensation for loss of office of a director can be made under Section 202(1) when the director’s office becomes vacant as outlined in sub-section (1) of Section 167 of the Companies Act. In other words, if a director vacates their office due to any of the conditions specified in Section 167(1), they are not entitled to compensation for the loss of that office under Section 202(1). This provision ensures that compensation is not granted in cases where directors are disqualified or removed from their positions as per sub-section (1) of Section 167 of the Companies Act, 2013.

Conclusion

In conclusion, Section 167 of Companies Act, 2013, serves as the sentinel of corporate governance in India. It outlines the circumstances under which a director’s office can be vacated, emphasizing accountability, transparency, and adherence to the law. From disqualifications to absences, this section meticulously defines the boundaries of directorship.

Moreover, the power granted to private companies to augment these provisions in their articles of association demonstrates the Act’s adaptability to meet the unique needs of businesses. It’s a testament to India’s commitment to fostering a diverse and dynamic corporate landscape.

But let’s not forget the stern hand of justice that awaits those who knowingly flout these rules. Sub-section (2) of Section 167 of Companies Act, 2013 reinforces the importance of compliance with penalties that range from fines to imprisonment.

Frequently Ask Question

A director must vacate their office if they become disqualified due to various reasons, including disqualification by law or the company’s articles, non-compliance with shareholding requirements, or their bankruptcy according to Section 167 of the Companies Act, 2013.

The RoC plays a key role in maintaining records related to the appointment and vacation of office for directors and may take action in cases of non-compliance with Section 167 of the Companies Act, 2013.

The vacation of a director’s office due to non-attendance at board meetings under clause (b) of sub-section (1) of Section 167 of the Companies Act, 2013 is prospective in nature. This means that it applies from April 1, 2014, onward. If a director is absent from all board meetings during a twelve-month period starting from April 1, 2014, with or without obtaining leave of absence, their directorship becomes vacant. In essence, this provision looks forward from April 1, 2014, to assess non-attendance and its consequences.

If all directors of a company are disqualified, such as due to non-filing and non-payment defaults, the appointment of new directors is governed by sub-section (3) of Section 167 of the Companies Act, 2013. According to this provision, when all directors vacate their offices due to disqualifications specified under Section 167 of the Companies Act, the appointment of the required number of directors will be made by the promoter or, in the promoter’s absence, by the Central Government. These appointed directors will hold office until new directors are officially appointed by the company in a general meeting.

The requirement of clause (b) of sub-section (1) of Section 167 of the Companies Act is only for attendance of a Director in the Board Meeting. It does not deal or regulate the manner of attending the Board Meeting. A Board Meeting attended by any Director, whether in person or through video conferencing or other audio visual means, shall be sufficient attendance for the purpose of section 167(1)(b).

Directors are generally not personally liable for company debts, but they can be held personally liable for damages resulting from breaches of their legal duties.

The Companies Act of 2013 does not impose any restrictions on the re-appointment of a director who has vacated their office due to Section 167(1)(b). Such a director is not disqualified from being re-appointed as a director, either within the same company or in any other company. The company has the flexibility to re-appoint the same director, which can be done in accordance with the provisions outlined in Section 161(1) or Section 161(4) of the Act.

In this scenario, the company is required to submit the DIR-12 form twice. First, to notify the cessation of the director, and second, to inform about the director’s re-appointment.

Read Our Article: Section 30 Of Companies Act, 2013