A Memorandum of Deposit of Title Deed (MODT) is a legal document that allows borrowers to deposit their property documents with the lender as collateral for a loan. This document serves as proof of ownership of the property and is used to secure the loan. In this blog, we will discuss the purpose, process, role and format of the MODT.

MODT

When a borrower takes a home loan, the lender requires the deposit of the property documents as collateral to secure the loan. The Memorandum of Deposit of Title Deed (MODT) is the legal document that formalizes this deposit of property documents with the lender. It creates a charge on the property in favor of the lender, which gives them the right to sell the property to recover the loan amount in case of default.

The Memorandum of Deposit of Title Deed (MODT) typically includes the names and details of the parties involved in the transaction, a detailed description of the property, loan details, depository details, execution details, and registration details. It is a legally enforceable document that is registered with the appropriate authorities, such as the Sub-Registrar of Assurances, to make it legally enforceable.

In summary, the Memorandum of Deposit of Title Deed (MODT) is a legal document that creates a charge on the property in favor of the lender and formalizes the deposit of property documents as collateral for a loan, typically in the context of a home loan. It is an important document in the home loan process that protects the lender’s interests in case of default by the borrower.

Process of MODT

The process of creating a Memorandum of Deposit of Title Deed (MODT) involves several steps, including the preparation of the document, registration, and handover of property documents to the lender. Here is a detailed process of creating an MODT:

Step 1: Preparation of MODT

The borrower has to prepare the Memorandum of Deposit of Title Deed (MODT) on a non-judicial stamp paper of the required value. The document should include the details of the property, the borrower, and the lender, along with the loan amount and interest rate. It is advisable to take the help of a legal expert or a lawyer to prepare the MODT to ensure that all the necessary details are included and the document is legally valid.

Step 2: Execution of MODT

After the preparation of the Memorandum of Deposit of Title Deed (MODT), the borrower has to sign the document in the presence of two witnesses. The lender also has to sign the document to acknowledge the deposit of property documents as collateral for the loan.

Step 3: Registration of MODT

Once the Memorandum of Deposit of Title Deed (MODT) is executed, it has to be registered with the Sub-Registrar of Assurances under whose jurisdiction the property is located. The borrower has to pay the registration fees and present the original property documents along with the MODT. The Sub-Registrar[1] will verify the documents and register the MODT, and stamp it with the registration seal.

Step 4: Handing over of Property Documents

After the MODT is registered, the borrower has to hand over the original property documents to the lender. The lender will keep the documents safe until the loan is repaid in full. The borrower should make a note of the documents handed over to the lender in a separate document and ensure that it is signed by both parties.

Step 5: Release of Property Documents

Once the loan is repaid in full, the lender has to release the property documents to the borrower. The borrower can then approach the Sub-Registrar of Assurances to get the MODT canceled. The Sub-Registrar will cancel the MODT and return the property documents to the borrower.

Purpose of MODT

The primary purpose of a Memorandum of Deposit of Title Deed (MODT) is to provide security for a loan taken by a borrower. By depositing the property documents with the lender, the borrower creates a charge on the property in favor of the lender. This charge serves as security for the loan and enables the lender to recover the loan amount by selling the property in case of default by the borrower.

The MODT is an essential legal document that enables borrowers to secure a loan by depositing their property documents with the lender. It provides a legal framework for the lender to take possession of the property documents and create a charge on the property as security for the loan. In case of default by the borrower, the lender can sell the property to recover the loan amount.

The MODT is used in various types of loans, such as home loans, business loans, and personal loans, where the property is used as collateral. It protects the interests of both the borrower and the lender and provides a legal basis for the transaction.

The purpose of the MODT is to create a legal framework for securing a loan by depositing property documents with the lender. It provides security to the lender and enables the borrower to avail loans by using their property as collateral.

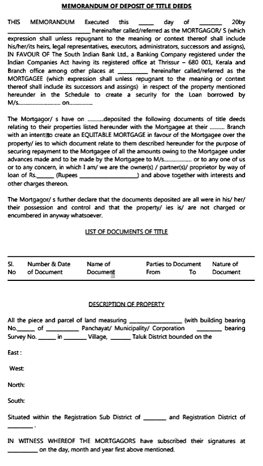

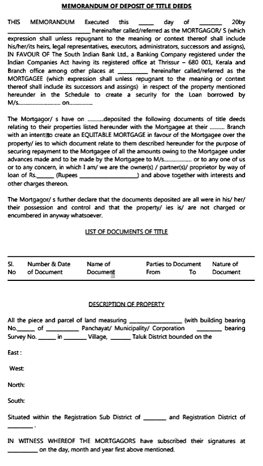

Format of MODT

The format of a Memorandum of Deposit of Title Deed (MODT) may vary based on the requirements of the lender and the jurisdiction under which the property is located. However, a typical MODT format includes the following information:

- Heading: The document should start with a heading that clearly mentions the name of the document, such as “Memorandum of Deposit of Title Deed.”

- Parties Involved: The next section should provide the names and details of the parties involved in the transaction. This section should include the name and address of the borrower, the lender, and the witnesses.

- Property Details: The MODT should include a detailed description of the property that is being deposited as collateral for the loan. The description should include the location of the property, the survey number, the land area, and other relevant details.

- Loan Details: The MODT should include details of the loan, such as the loan amount, interest rate, repayment schedule, and any other relevant terms and conditions.

- Depository Details: The MODT should mention the name and address of the entity that will keep the property documents safe until the loan is repaid in full.

- Execution Details: The document should include a section for the signatures of the borrower, the lender, and the witnesses. The borrower should sign the MODT in the presence of two witnesses, and the lender should sign the document to acknowledge the deposit of the property documents.

- Registration Details: The MODT should include details of the registration, such as the date of registration, the registration number, and the name and address of the Sub-Registrar of Assurances.

Overall, the format of an MODT should be clear and concise, with all the necessary details included. It is advisable to take the help of a legal expert or a lawyer to ensure that the MODT is legally valid and enforceable.

Role of MODT

In the context of a home loan, a Memorandum of Deposit of Title Deed (MODT) plays a crucial role in providing security for the loan taken by the borrower. The MODT is a legal document that enables the borrower to deposit the property documents with the lender as collateral for the loan.

When a borrower takes a home loan, the lender requires some form of security to protect their interest in the loan. In this case, the property itself serves as security, and the MODT is the legal document that formalizes the deposit of the property documents with the lender.

The MODT creates a charge on the property in favor of the lender, which gives them the right to sell the property to recover the loan amount in case the borrower defaults on the loan. This charge is registered with the appropriate authorities, such as the Sub-Registrar of Assurances, to make it legally enforceable.

The MODT is an essential document in a home loan transaction as it protects the interests of both the borrower and the lender. It enables the borrower to avail of a loan by using their property as collateral, and it provides the lender with a legal basis to take possession of the property documents and sell the property to recover the loan amount in case of default.

MODT plays a critical role in a home loan transaction by providing security for the loan and creating a legal framework for the deposit of property documents as collateral. It is a crucial document that protects the interests of both the borrower and the lender and enables smooth and secure home loan transactions.

Is MODT charges mandatory for home loans?

The requirement of Memorandum of Deposit of Title Deed (MODT) charges for home loans depends on the policies of the lender and the type of loan. In most cases, when a borrower takes a home loan, the lender requires the deposit of the property documents as collateral to secure the loan. The MODT is the legal document that formalizes this deposit of property documents with the lender.

The MODT creates a charge on the property in favor of the lender, which gives them the right to sell the property to recover the loan amount in case the borrower defaults on the loan. This charge is registered with the appropriate authorities, such as the Sub-Registrar of Assurances, to make it legally enforceable.

While MODT charges are not mandatory for all home loans, they are usually required for secured home loans where the property is used as collateral. The MODT charges are usually a percentage of the loan amount and are payable by the borrower.

In some cases, the lender may waive the requirement of MODT charges if they feel that the borrower is financially stable and poses a low risk of defaulting on the loan. However, this is subject to the discretion of the lender and may not be applicable in all cases.

While MODT charges are not mandatory for all home loans, they are usually required for secured home loans where the property is used as collateral. The requirement of MODT charges depends on the policies of the lender and the type of loan, and it is advisable to check with the lender regarding the same.

Legal regulations of MODT

The MODT or Memorandum of Deposit of Title Deed is a legally binding document that is governed by various legal regulations. Some of the key legal regulations related to MODT are:

- Transfer of Property Act, 1882: The Transfer of Property Act, 1882, is the primary law that governs the transfer of property in India. Section 58 of the Act deals with the creation of a mortgage by deposit of title deeds. It lays down the legal framework for creating a charge on the property in favor of the lender through the MODT deed.

- Indian Registration Act, 1908: The Indian Registration Act, 1908, is the law that governs the registration of documents, including the MODT deed. The Act requires the MODT deed to be registered with the appropriate authorities, such as the Sub-Registrar of Assurances, to make it legally enforceable.

- Reserve Bank of India (RBI) Regulations: The Reserve Bank of India (RBI) is the central bank of India and regulates the banking sector in the country. The RBI has issued guidelines to banks and financial institutions on the creation and registration of the MODT deed. The guidelines require the MODT deed to be registered with the appropriate authorities and to contain all the necessary details of the loan and the property.

- Stamp Duty: The MODT deed is also subject to stamp duty, which is a tax levied on legal documents. The stamp duty rates vary from state to state, and the amount of stamp duty payable on the MODT deed depends on the loan amount and the value of the property.

The deed is governed by various legal regulations, including the Transfer of Property Act, Indian Registration Act, RBI regulations, and stamp duty laws. It is important to ensure that all the legal requirements related to the MODT deed are complied with to make it legally enforceable and to protect the interests of both the borrower and the lender.

Conclusion

In conclusion, the Memorandum of Deposit of Title Deed (MODT) is an essential legal document that enables borrowers to secure a loan by depositing their property documents with the lender. The process of creating an MODT involves the preparation, registration, and handover of property documents to the lender. The format of the MODT includes details such as the name and address of the borrower and lender, property description, loan amount, and interest rate.

Read our Article: Register Of Members Under The Companies Act, 2013