Getting your electronic gadgets imported, but STOP. India has instantly restricted the importation of desktop, notebook, and palmtop computers, automatic data processing equipment, microcomputers/processors, and large/mainframe computers. The Directorate General of Foreign Trade announced restrictions on computer imports and other imports falling under the seven categories of HSN code 8471 on Thursday (August 3). Still, the limits do not apply to imports covered by the baggage regulations. The government has been actively bringing policies to line up India as a desirable location for investment with leading corporations worldwide.

Many businesses, such as Apple, Foxconn, Walmart, and others, have already made significant investments in India that would lead to opening local branches and stores. A detailed overview related to impact and reasons for restricting the import of computer hardware to India.

The Harmonized System of Nomenclature

- Every item that is traded internationally is given a distinct code by the HSN system.

- Customs officials from all over the world identify imported goods and determine applicable tariffs using the HSN code.

- Additionally, it is used by exporters and traders to declare their products and follow the laws governing origin.

- The World Customs Organization (WCO)[1] created the HSN code in 1988, and it is updated every five years.

Takeaway for Import of Computer Hardware to India

- India has import licensing requirements for personal computers, tablets, and laptops.

- Due to security concerns, the regulation aims to decrease imports from China and increase local manufacturing in India.

- In India, the market for laptops is anticipated to grow to $8.1 billion by 2028.

Aim of the rules

- Reduced reliance on foreign markets is the goal of policy

- India is attempting to become a hub for global manufacturing

- The move demonstrates a strong commitment to fostering domestic production

Justifications for restricting Import of Computer hardware to India

- These limitations increase domestic manufacturing, and there will be a decrease in reliance on imports from other countries, particularly imports from China, and an increase in India’s technological independence.

- Government initiatives are boosting domestic manufacturing through the revived production-linked incentive (PLI) program for IT hardware as it encourages significant investments in the value chain and increases domestic manufacturing through offering a financial incentive.

- The restrictions are there to prevent the entry of electronic hardware with security flaws that could jeopardize confidential personal and business information.

- The government wants to create an environment where domestic producers can increase their global reach by limiting imports.

Impact due to the Import of Computer hardware to India

- The marketability of specific models and supply chain disruptions would occur due to import.

- Given that importers will need to apply for licenses and wait for approvals, the policy is likely to lead to a short-term shortage of supplies. The prices would increase, and there would be fewer servers, laptops, tablets, and personal computers available.

- If imports are restricted, consumers may switch to locally-made laptops, which could benefit domestic manufacturers.

- Encouraging the growth of manufacturing domestic laptops capacity, which results in more sophisticated and competitive products

- The policy will also impact the existing players in the laptop market, including Dell, HP, Lenovo, Acer, Asus, and Apple, who have been importing most of their goods from China, Vietnam, Taiwan, and other nations. They will have to either move their manufacturing to India or buy from regional suppliers who can meet the required quality standards.

- A plus point will be for the new businesses and regional producers who can take advantage of the Production Linked Incentive Scheme for IT Hardware for financial incentives to boost domestic manufacturing and attract significant investments in the value chain.

- A suitable incentive targeted at export-oriented laptop and tablet manufacturing, as well as calibrated, sector-specific policy interventions, were also advised by the report. This will encourage business people to build factories in India and help to make up for the disadvantages of China and Vietnam. It will be essential to realize “Atmanirbhar Bharat” and “Make in India” for the world and lessen reliance on China.

Custom Duty and Computer Hardware

For personal computers with the HS Code 84713010, the customs duty in India is 0%. Under HS Code 84715000, the customs duty on computer processors is also 0%. Computers and other electronic products are subject to an 18% GST (Goods and Services Tax). There is an 18% overall tax on desktop computers.

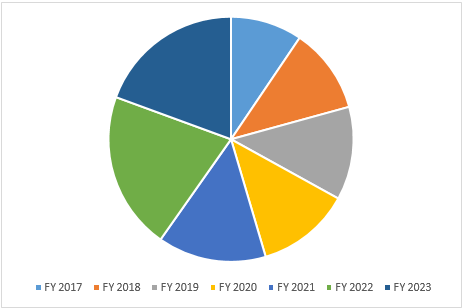

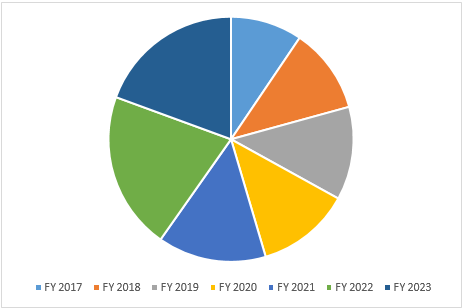

Statistical data

Fig. Import value of computer hardware to India from financial year 2017 to 2023

Conclusion

Given the current geopolitical climate, India has a good chance to contribute significantly to the global electronics supply chain. The Indian Cellular and Electronics Associations (ICEA) and EY report states that obtaining 18% of global exports and becoming the hub for laptops and tablets are two ways to achieve this strategic goal.

FAQs

Ans- The customs duty on computers in India is 0% for personal computers under HS Code 84713010. The customs duty on computer processors is also 0% under HS Code 84715000. The Goods and Services Tax (GST) for electronic goods, including computers, is 18%. The total duty for desktop computers is 18%

Ans – Every item that is traded internationally is given a distinct code by the HSN system. Customs officials from all over the world identify imported goods and determine applicable tariffs using the HSN code.

Ans- India has instantly restricted the importation of desktop, notebook, and palmtop computers as well as automatic data processing equipment, microcomputers/processors, and large/mainframe computers.

Ans- Wholesale Computer Market

• Reduced reliance on foreign markets is the goal of policy • India is attempting to become a hub for global manufacturing • The move demonstrates a strong commitment to fostering domestic production

Read Our Article: Overview Of Computer Hardware Scrap License Requirements