GST Registration Revocation Status: The GST framework in India makes it compulsory for all businesses and individuals that have an annual turnover of forty lakhs or more to register under the GST. For the special category states, the threshold is twenty lakh or more. The businesses that are involved in inter-state business, which means the business takes place from one state to another, also have to register with GST.

When the taxpayer is no longer liable for paying the taxes, the taxpayer can cancel the GST registration. When a GST registration is canceled with the assistance of an authority, the taxpayer cannot supply any taxable goods or services. To be eligible for taxable goods and services, the taxpayer must revoke the GST registration. Supply the goods and services that are taxable in nature without having a GST registration or revoking the previous canceled GST; the individual’s activity will be considered an offense and will result in penalties and fines by the GST authorities.

What is GST Registration Revocation?

The process by which the GST registration is cancelled by the GST authorities is called GST registration revocation. It is significant to know how to check the GST revocation status. The status informs the taxpayer at which stage the revocation is currently at. The GST registration revocation takes place either voluntarily or by the GST authorities.

Why is the Revocation of GST Registration Essential?

When the taxpayer does not make an application for the revocation of cancellation, it is deemed a’ deficiency’, as per Rule 9(2) of the CGST Rules 2017. This can also be considered a valid ground for any future new registration application. If the taxpayer continuously trades supplies and goods with the GST registration, this type of trade will be considered an offense per the laws of Goods and Service Tax. The taxpayers shall also be liable to hefty penalties.

Reasons for GST Revocation

There are certain grounds for canceling a GST-granted registration. The GST authorities can decide to cancel on their own accord, or the registered taxpayer may request that their GST registration be canceled.

The legal representatives can ask for cancellation in the event of the registered taxpayer’s demise if ownership is involved. Additionally, there is a clause allowing the taxpayer to revoke the GST authorities’ cancellation of their registration if the department has done so.

Some of the reasons for GST revocation are:

- The business as a whole or a part of the business is a transfer

- The death of the business owner

- If the individuals do not incorporate the business as per section 25 (3).

- If the GST return is not filed for six months

- The taxpayers are not coming under the GST registration threshold

- The business structure is changed

- When the GST return for three continuous months is not filed under the GST composition scheme.

- When two business units are joined

- If the GST rules and regulations are not followed by the business

How to Check the GST Registration Revocation Status?

There are some steps which can be followed to check the GST registration revocation status by online means:

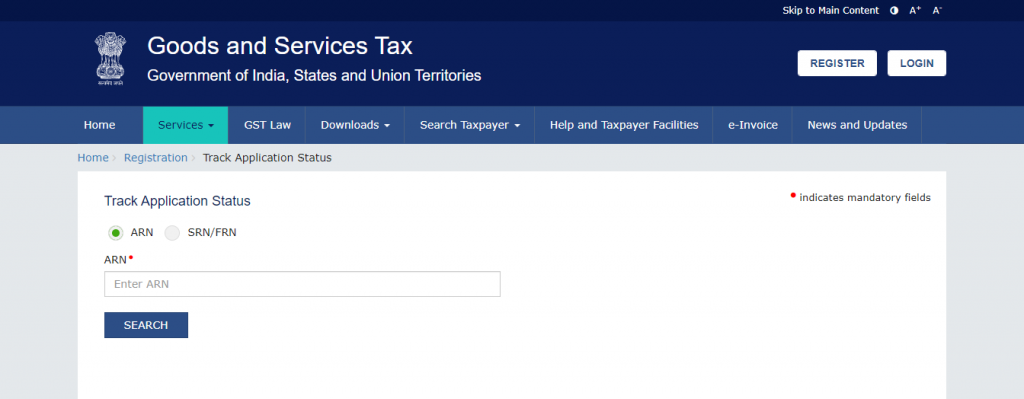

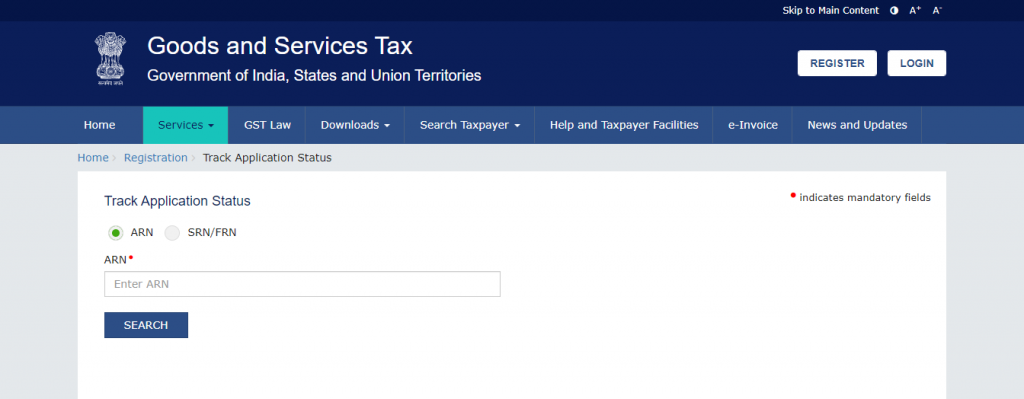

- Step 1: Visiting the Official GST website

You first have to visit the official GST website. This website will help you in checking the GST registration revocation status.

- Step 2: Services Option

After opening the website, you must click on the ‘services’ button on the homepage to check the GST revocation status.

- Step 3: Registration Option

A dropdown option will appear on the screen. Select the ‘registration’ button from that list. Then, click on the track application status option.

- Step 4: Choosing the ‘View GSTIN Information’ option

The next step is to choose the option ‘View GSTIN Information’ from the services option.

- Step 5: GSTIN and Captcha Code

You will now have to fill in your GSTIN and Captcha Code to proceed. Both details must be filled in correctly, or else you won’t be able to check the GST registration revocation status.

- Step 6: Ensuring Accuracy

After checking both the Captcha Code and GSTIN, click on the ‘proceed’ option. You will receive an OTP, which you must enter to proceed.

- Step 7: GST registration revocation status

A window will open that will show all the information related to the GST registration. You can also see the GST revocation status on this screen in the ‘Current Status Box’. It will show your current status.

GST Registration Revocation Status Check by Other Methods

There are various other ways through which we can check the GST registration revocation status.

- Professional Guidance

When you want to check the GST registration revocation status, and you can do it yourself, you can always contact a GST professional who has the knowledge and experience to do it. These professionals offer services like these to many taxpayers regularly. They help you in checking the GST revocation status along with many other GST-related matters.

- Visiting the GST Office

If they have any problems using the website, individuals can also visit the GST office of their city to check the GST registration revocation status. Taxpayers can take the relevant information, visit the GST office, and connect with the representative there.

- Helpdesk of GST

If you are having difficulties operating the website, you can also contact the GST helpdesk by mail or call to check the GST registration revocation status. You can get the contact details and the mail ID from the GST’s official website. You can provide the details to the helpdesk to check the status.

Documents Required for Revocation of GST Registration

Some essential documents might be needed at the time of checking the GST revocation status.

- Contact details (email and phone number) that are used for GST registration

- Reason and explanation for canceling the GST registration

- GST payment documents

- Information of any stock if there

- All the details for GST dues, penalties, or fines

- Goods and Service Tax Identification Number

The Final Words

To sum up, monitoring the GST registration revocation status is significant for compliance maintenance with regulations. The whole process of checking the GST registration revocation status can be made simpler by expert advice from Corpbiz advisors. The taxpayer can very easily check the status of the revocation status; a check regularly is considered the best option.

Frequently Asked Questions

What can be the reason behind my GST registration revocation?

If any of the rules and regulations mentioned by the GST department are not complied with by any taxpayer for a certain period or they are involved in some fraudulent activities, then the GST registration can be revoked.

How can I request a revocation of GST registration?

To request the revocation of GST registration, you can make an application to the GST authorities by visiting the GST website.

Can I file a return after the GST registration revocation?

An individual eligible for paying tax and who is also registered with GST must file a return when the GST registration is surrendered or cancelled as the final return with the form GSTR–10.

How to write a revocation application for goods and service tax?

You have to write an application formally to the GST authorities when you want to revoke the GST registration. All the important details, such as GSTIN, revocation reasons, registered address, and other pertinent information, have to be included in the application.

Can I check my GST registration revocation status online?

You can check your GST registration revocation status online by following simple steps.

What paperwork is required for GST revocation?

The documents required can vary from application to application. The general paperwork required is the revocation application, bank and financial statements, and other documents related to compliance.

Can I voluntarily apply for GST revocation?

Yes, we can voluntarily apply for GST revocation and check the status of GST registration revocation from the website itself.

How long does the process of GST revocation take?

The total time can be different depending on the case, but the revocation process can take approximately 15-30 days from the date the application was filed.

Read our article GSTN Advisory For OPC Registration