The Banking Regulation Bill, 2020 has been introduced by the Finance Minister in the wake of the crisis at the PMC Bank last year.

The Honorable Finance Minister of India, Nirmala Sitharaman on Tuesday introduced the Banking Regulation (Amendment) Bill, 2020 in Lok Sabha which seeks to give the Reserve Bank of India (RBI) the power to regulate cooperative banks. The Bill is proposed to strengthen the cooperative banks by increasing professionalism, improving governance and ensuring sound banking through the RBI. The Banking Regulation (Amendment) Bill aims to prevent frauds as we saw in the case of “Punjab and Maharashtra Co-operative (PMC) Bank Ltd”.

Statement of FM on Banking Regulation (Amendment) Bill, 2020

While presenting the Bill in the parliament, the finance minister stated that it is the ‘need of the hour’ to evade a PMC Bank-like crisis in the near future.

The FM mentioned that:

The said bill seeks to amend the Banking Regulation Act, 1949[1]. It is proposed to bring the cooperative banks at par with the developments in the banking sector through proper regulation and better management of cooperative banks. The Bill seeks to ensure that the affairs of the cooperative banks are conducted in a manner that protects the interests of the depositors.

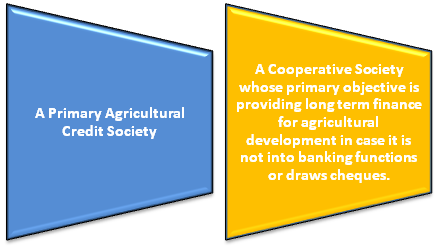

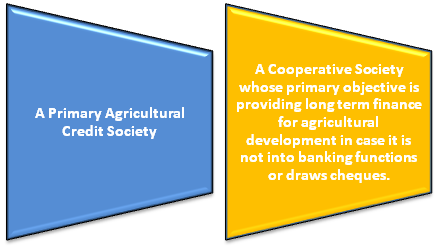

The proposed Bill will not be applicable to:

Currently, Co-operative Banks are under the dual control of the Registrar of Co-operative Societies and the Reserve Bank of India (RBI). The Registrar of Cooperative Societies are involved in incorporation, registration, management, audit, supersession of board and liquidation of co-operative banks while RBI is responsible for regulatory functions like maintaining cash reserve and capital adequacy, among others.

Key Pointers of Banking Regulation Bill, 2020

- The proposed Bill provide for the issue and regulation of paid-up share capital and securities by cooperative banks.

- Further, the Bill provides that in the case of a cooperative bank registered with the Registrar of Cooperative Societies of a state, the Reserve bank of India shall consult the concerned State Government before issuing an order for the super-session of the board of directors under section 36AAA.

This Bill was introduced by the FM in the wake of the crisis at PMC Bank last year. Last year the PMC Bank was found to have given over Rs 6,700 crore loan to the real estate firm HDIL through allegedly fraudulent means and moreover, hid the stress from RBI by creating separate books of accounts. When the irregularities were uncovered, the cash withdrawals were capped at Rs 1,000 per account for six months, but subsequently relaxed to Rs 50,000 as panic spread among depositors.

The Banking Regulation Bill, however, could not be passed as the proceedings in the Lok Sabha were disrupted as the ruling party and the opposition members argued over recent Delhi violence.

Take Away

The Banking Regulation (Amendment) Bill, 2020 for co-operative banks proposed by the Finance Minister seeks to strengthen the cooperative banks by increasing professionalism, improving governance and ensuring sound banking through the RBI.

Read our article:CARO 2020: New Norms Issued for Auditors

56-_2020_LS_ENG