Partnership firm registration in India is done as per the Indian Partnership Act, 1932. his type of firms are registered by the (ROC) Registrar of Company of the respective state.

You need to prepare a partnership deed between the partners to determine the responsibilities of each partner. This article covers all the characteristics of Partnership firm Registration in India.

What is Partnership Firm?

Indian Partnership Act of 1932[1] defines partnership as the relation between a people who has agreed to share profit and loss of a business carried on by them. The partners share their profits and losses in the proportion of their respective owner.

The amount of capital contributed by each partner can provide the total capital required. The decision-making method in a partnership firm is a corporate business. Every partner should be on the same side before taking any decision. Without incorporation of partnership, two partners cannot start their business venture.

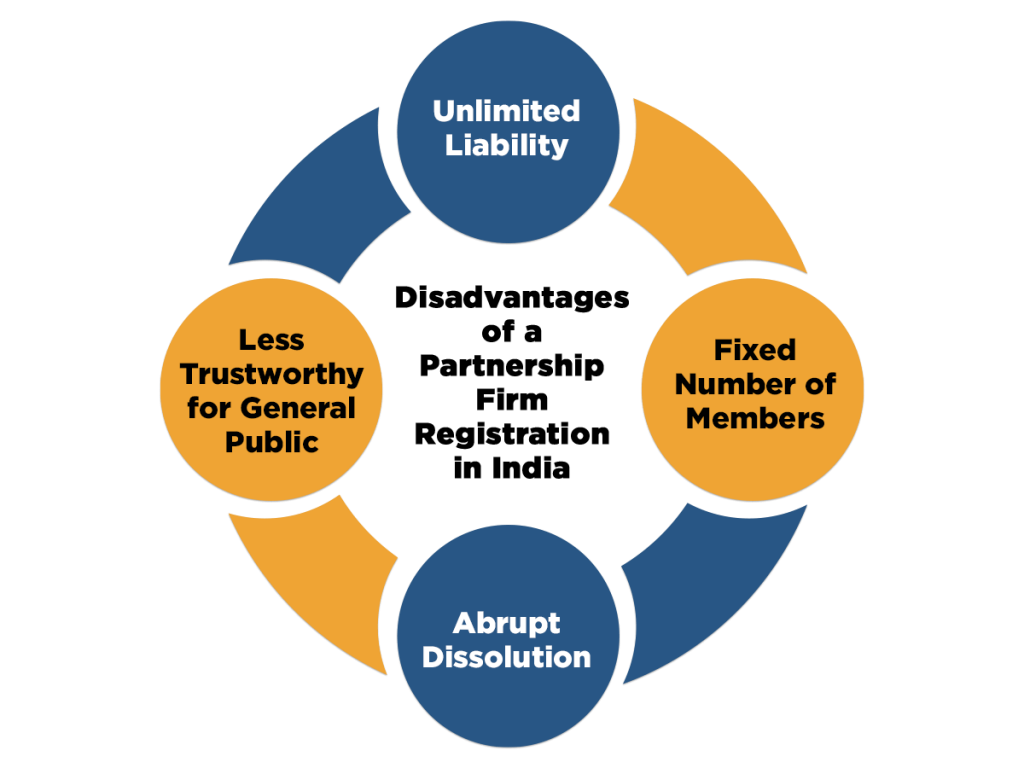

Advantages of Partnership Firm Registration in India

Easy Business Structure

A partnership firm in India can be formed effortlessly because the only thing you need is partnership deed to get yourself registered. It takes around 10-15 days to cover all the formalities.

Easy Decision Making

It is easier to make decisions in this type of firm as there are no regulations to pass a resolution.

Fundraising is Easy

Funds can be easily raised because a partnership firm has multiple partners, and they are capable of raising more contribution. Bank also consider partnership firm for sanctioning loans.

Easy Management

In the Partnership deed, it has been mentioned the work and responsibility assigned to each partner according to their capability.

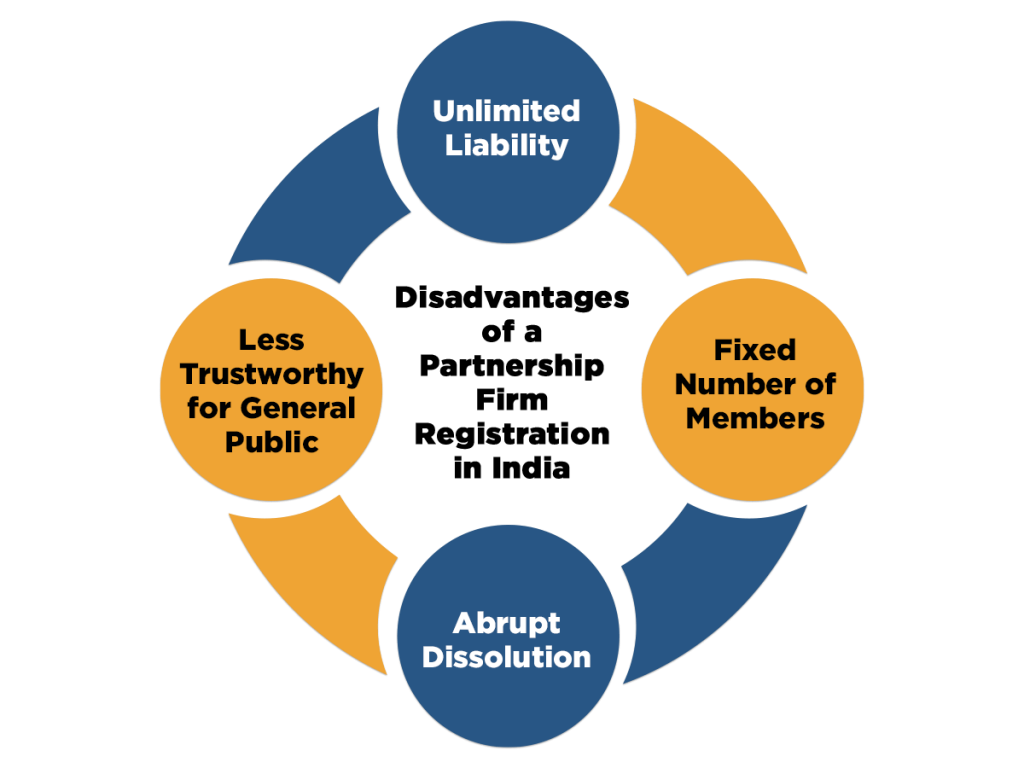

Disadvantages of a Partnership Firm Registration in India

Unlimited Liability

The liability of the partners is not limited to the partnership firm; in the case of debt partners, personal assets can be used.

Fixed Numbers of Members

Maximum numbers of members are set to 20.

Less Trustworthy for the General Public

A partnership firm can also work without incorporation. It also operates without any strict rules and regulations, which makes it less reliable.

Abrupt Dissolution

It can easily dissolve in case of death or insolvency of a partner and this hampers the business growth.

What are the vaious Documents required for Partnership Firm Registration?

The documents required are stated below:-

Partnership Deed

It is a type of agreement formed between the partners who describe the rules, duties and functions. It helps to avoid conflicts between the partners of the firm. A partnership deed is created and signed by all the members on a judicial stamp which costs around Rs. 2000.

PAN

For the identity proof, every partner has to submit their PAN.

Address Proof

The partners have to submit their address proof which can be their aadhar card or PAN.

Office Address Proof

Address proof of the working place is to be submitted. If the property is rented, then the rent agreement along with electricity or water bill and NOC has to be provided.

What are the Documents Required for GST Registration of Partnership Firm?

To obtain a GST registration, a firm is required to submit PAN details, address proof of the firm and identity as well as address proofs of partners. Authorized person will sign the application either using Digital Signature Certificate (DSC) or E-Aadhar verification.

How to open Current Bank Account for a Partnership Firm?

For opening a current bank account for a Partnership, a firm is required to submit the following documents-

- Partnership deed

- Partnership firm PAN card

- Address Proof of the firm

- ID proofs of all the partners

- Partnership registration certificate

- Any registration document that is issued by central or state government (normally GST certificate is submitted)

- Copy of electricity bill, water bill or telephone bill

- Authorization letter by the firm on the letterhead that authorizes a partner as authorized signatory for the bank account.

How to get a Partnership Firm registered in India?

At the very first, you should select an Appropriate Name for the Firm, file an application, then prepare Partnership Deed along with the Submission of Documents heading with the Issuance of Certificate.

Select an Appropriate Name for the Firm

The name should be unique, and it should not consist of words that show government approval.

File an Application

An application is to be filed with the respective registrar of firm in the proper format with the prescribed fees.

Prepare Partnership Deed

Following information are required in a partnership deed:-

General Details

- Name & Address of the firm

- Name & Address all the partners

- Nature of business

- Date of starting of business

- Capital to be contributed by each partner

- Profit/loss sharing ratio among the partners

Specific Details

Certain specific clauses are required to be mentioned to avoid any conflict in the future-

- Interest on capital invested

- Any loans provided by partners to firm

- Salaries or commissions to be payable

- Rights of each partner

- Duties and obligations of all the partners

- Adjustments or processes to be followed in case of retirement or death of a partner as well as dissolution of firm.

- Other clauses decided by mutual discussion

Documents Submission

All the required documents along with the partnership deed are to be submitted

Issuance of Certificate

All the required documents provided are verified by the authority, and if everything is correct, the certificate of Partnership firm registration is granted.

What is the Need for partnership firm registration?

If you don’t register your partnership company then:-

- Partner of Unregistered Firm Cannot Sue any Firm enforcing any right under Indian Partnership Act, 1932

- Cannot Claim Setoff with Third Party

- The Firm cannot Third Party but Third Party can be able to Sue Irrespective of the Registration.

Conclusion

The Partnership act supervises the registration, formation and governance of the partnership firm. Partnership firms are easy to set up and easily manageable. Therefore, business partnerships are beneficial for you if you are willing to starting a new business. To get your partnership company registration in India, contact Corpbiz.

Read our article:Partnership Firm Registration and Annual Compliances