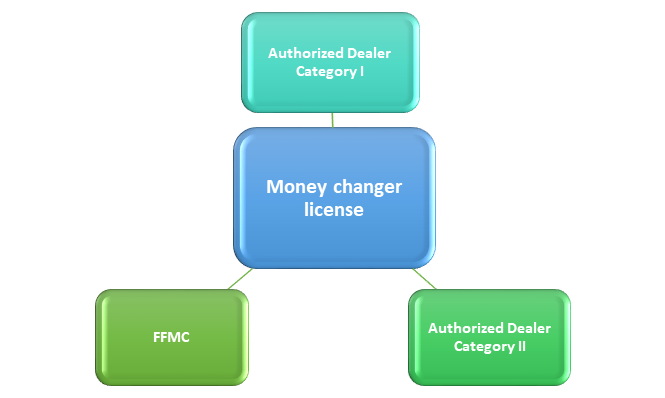

FFMC license serves those corporates who are willing to take part in the money-changing activity in India. The cross-border monetary exchange comes under the strict provision of law, and it can only be conducted when a company acquired an FFMC license. Full Fledged Money Changers (FFMC) based entities do their business as per the RBIs guidelines and Foreign Exchange Management Act, 1990 section 10.

Full Fledge Money Changer License In India (FFMC)

Every year RBI rolled out a circular on a memorandum of instruction on money changing activities to make companies aware of compliance and provision regarding forex exchange. The company’s personals are supposed to go through this circular in detail if they want to obtain an FFMC license in a hassle-free manner. This circular is also accompanied by the provision of the Foreign Exchange Management Act, 1999.

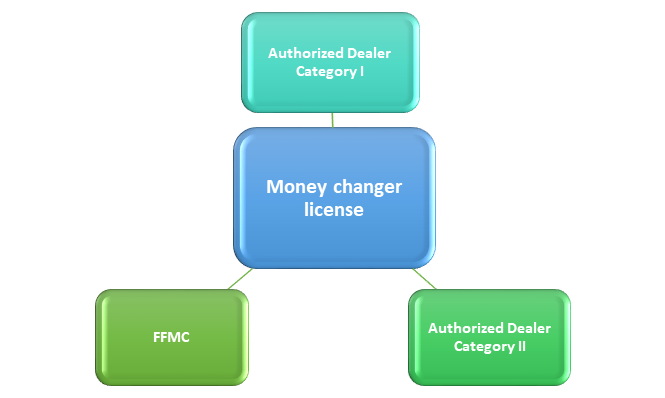

Entities other than an organized bank can also obtain an FFMC license and conduct forex exchange activities with ease. Such firms, in the legal term, are tagged as Authorized Dealer Category II.

What are the Eligibilities?

Eligibility criteria to obtain the FFMC license are pretty straightforward. The companies that are willing to be a part of the forex exchange business must be registered under the Companies Act 2013[1].

Required Conditions to apply for FFMC License

- In order to obtain FFMC License, a company should possess a registration of Registrar of Companies under Companies Act 2013.

- The company whose intent is to raise the license for a single branch must hold a net owned fund of Rs. 25 lakhs. Meanwhile, in the case of multiple branches, this limit goes to Rs. 50 lakhs.

- The company’s primary activity mentioned in the object clause should not be other than money changing business.

- The company should have a spotless track record, and it should have no pending cases w.r.t Department of Enforcement or Department of Revenue Intelligence. The concerned company must conduct a spot audit regularly to rectify the chances of such a violation.

Franchise License from existing FFMC

Companies who are looking to engage in a forex exchange business need to procure at least Rs. 10 Lakh net owned fund. Also, their business motive should be reflected in the company’s memorandum as well. These requirements are essential from the license point of view. Under no conditions, the franchise can execute money-changing business by violating provision under master circular of RBI. To ensure seamless functioning of operation and maintenance, franchisers have to act as a guiding light to franchisees.

Reporting

Franchises that represent authorized dealer category I or approved dealer class II or FFMCs expect the franchise to render regular reporting regarding the transaction to the franchisor.

Regular spot audit every six months must be conducted by authorized dealer category I / authorized dealer category II / FFMCs to ensure transparency. To verify the franchise compliance’s prowess, a concept of ‘mystery customer’ should be used.

A system that supports the periodic inspection of a franchise’s book/record should be placed. The investigation will help the company rectifies the pain points. It will also keep them in the vicinity of the compliance and agreement as per RBI guideline. Franchisees must follow the KYC guidelines as it is a mandatory requirement for authorized dealer category I / authorized dealer class II / FFMCs.

Compliance

A concurrent auditor should conduct a thorough inspection of transactions to check their conformity with anti-money laundering guidelines. If one of the guidelines found to be compromised, the auditor must notify the board about the mishap at the earliest. A certificate from the statutory auditor should be obtained when preparing the Annual Report on compliance with AML guidelines.

Penalty Provisions

Reserve Bank of India (RBI) is the legal house in the country which authorizes FFMCs to engage in foreign exchange. The provision is duly mentioned in section 10(1) of the Foreign Exchange Management Act 1999.

Under no circumstances, the private firm or person engaged in money changing activity unless they have a required license to do so. Otherwise, they will be charged for a felony under this act, which is subjected to a penalty.

How to apply for FFMC License?

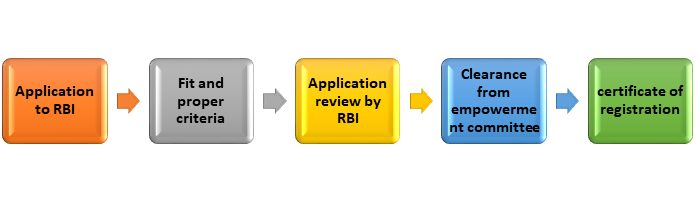

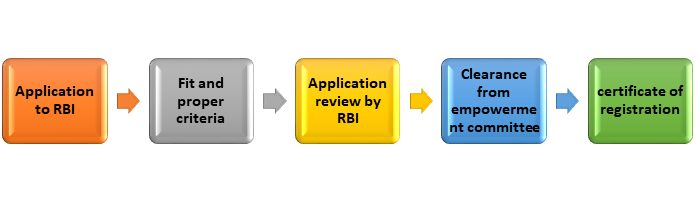

An applicant must submit an application accompanied by relevant documents to the foreign exchange department of RBI’s regional office where the company’s registered office is located.

Documents Required for FFMC License

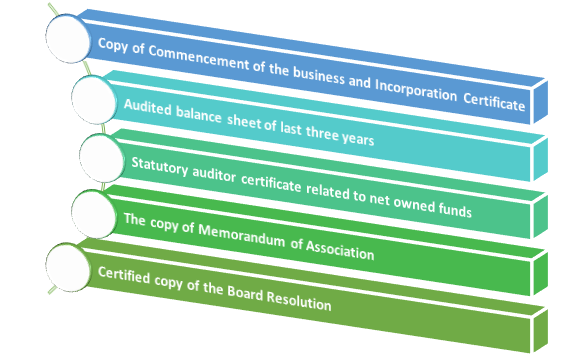

The licensing process of FFMC starts with the submission of the application that the applicant must render as per Annexure-II of RBIs Master Circular on Memorandum of Instruction on Money Changing Activities.

As per Reserve Bank of India guidelines, a declaration that a robust policy framework will be established to keep control of the activities like Anti Money Laundering, KYC, and CFT before the initiation of service and procurement of FFMC license from RBI. The renewal of the FMCC license must be done every year. To do so, the applicant needs to provide relevant documents to the RBI.

Application process of FFMC

Conclusion

FFMC license plays a vital role in authenticating the company’s role in running money changing activities in India. Also, FFMC license isn’t hard to avail of if the required procedure is followed by the company in a prudent manner. However, exceptions are everywhere, and if some of you encounter legal issues in this process, inform us without any delay.

Read our article:Guidelines For The FFMC License; A complete Overview