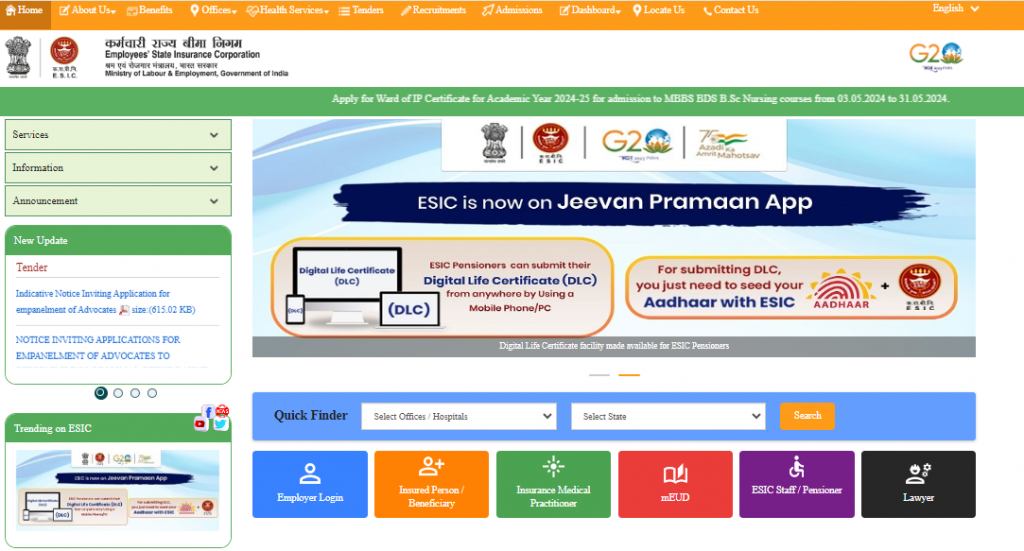

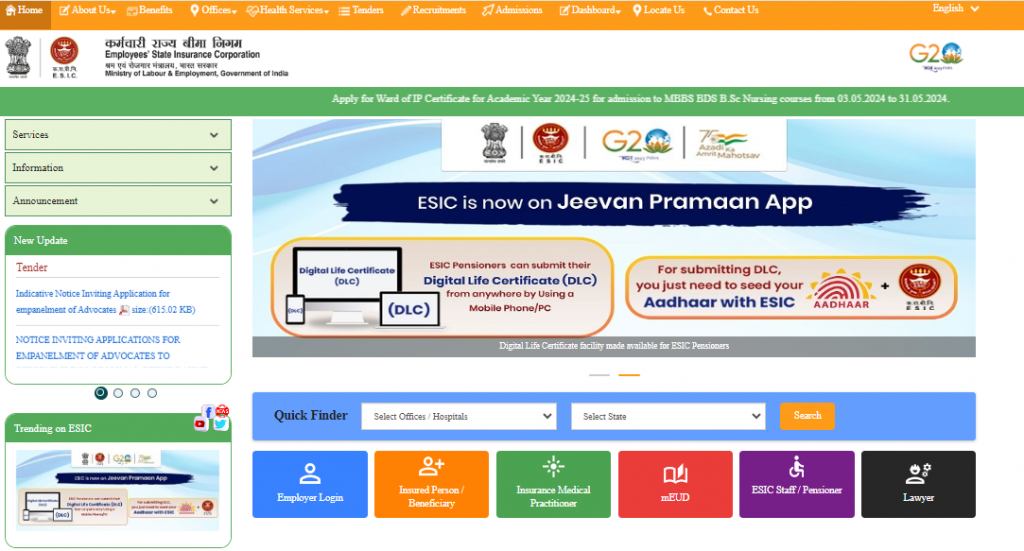

ESIC Portal is an online site that allows employers to contribute to their employees’ ESIC accounts every month. The ESIC portal includes additional features such as registration, login capabilities, a complete information guide, and a convenient platform for making payments.

You may be a new finance professional, HR manager, or business owner and would like to know how your employees’ ESIC accounts are paid. Without wasting your time, let’s start to understand this process.

What is ESIC?

ESIC (Employees’ State Insurance Corporation) is an independent organisation that manages the Employees’ State Insurance programme, which offers social security and health insurance to Indian workers. Individuals can pay their ESIC challan online.

Through its information and services portals, the ESI Scheme seeks to offer hassle-free services to businesses and employees. All payments and compliance are handled online as part of this endeavour. Through the platform, employers can submit their monthly contributions. For that, you need ESIC and a Password. Below, we will discuss how to register for the ESIC Portal.

How to Register to the ESIC Portal?

The following are the steps to register for the ESIC portal:

Step 1: Go to ESIC’s official website.

Step 2: The ‘Employer Sign-up’ option will appear on the homepage. Press that button.

Step 3: Fill out your personal information and press “Submit.”

Step 4: The ESIC portal will register you.

How do you log in to the ESIC Portal?

The following are the steps to register for the ESIC portal:

Step 1: Go to ESIC’s official website.

Step 2: The ‘Employer Sign-up’ option will appear on the homepage. Press that button.

Step 3: Fill out your personal information and press “Submit.”

Step 4: The ESIC portal will register you.

How to Make Payment on ESIC Portal Online?

In order to make payment on ESIC portal online, you need to follow the stepwise guide-

Step 1: Visit the official ESIC website and enter your login information.

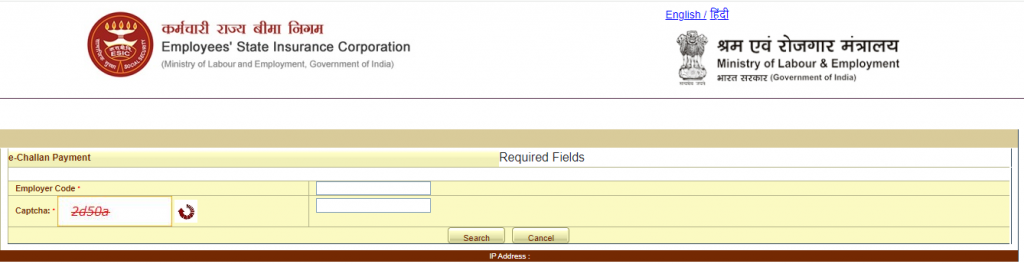

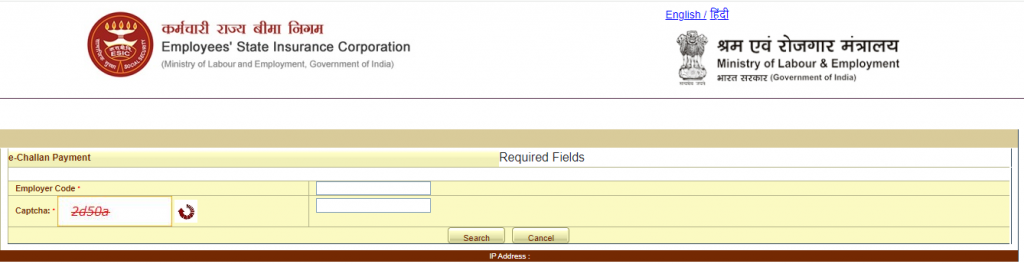

Step 2: A list of ESIC links and modules will appear on the page that has been redirected. To continue paying for the ESIC, click “Pay e-Challan.” This page will appear.

Step 3: Next, type in the employer code and the “CAPTCHA” before clicking “Search.”

Step 4: When you continue, a list of challans will appear. Choose the challan number to proceed with the payment.

Step 5: You can pay in several ways. One is via SBI, while the other is through other online banking services.

Step 6: The payment gateway will be displayed after selecting your bank from the drop-down menu.

Step 7: You will be prompted to input your credentials again before making a payment.

Step 8: You will now see a page with all of the challan’s details, along with a “Pay” button at the bottom.

Step 9: After completing the transaction, you will receive a successful payment receipt.

How do you Make Monthly Online Contribution Filings?

- Through the “Online Monthly Contribution Screen,” users can submit their monthly contributions.

- The “preview” page will be shown upon submission.

- Click the “Submit” button to send ESIC the information about your monthly contribution.

- The user has two options: either upload an Excel file as an attachment for bulk upload or manually enter the contribution for each employee. Using this for large amounts of data is accessible.

- By selecting Pay Online, the user can use SBI net banking to make an online payment after submitting it.

- To continue with the online payment, click “ok.”

- Please write down the Challan number for future use. To proceed with the payment, click “Continue,” redirecting you to the SBI online payment page.

- The user will be directed to the banking website, where online payments via net banking can be made as soon as you proceed with the payment. The user can then pay the amount after providing their net banking credentials.

How to Generate an Online Challan?

To generate your Challan online, you will need to take the following actions:

Step 1: Select the ‘Generate Challan’ link from the module list.

Step 2: Click the ‘View’ option after being redirected to the next page.

Step 3: Enter the required payment amount and choose the record against which the payment will be made.

Step 4: Select the “Online Option” and click “Submit.”

Step 5: A notification about the submission of the request will appear. Select ‘OK’ by clicking on it.

What Happens in the Case of Non-Payment or Delayed Payment of Contribution?

ESIC has the right to collect and recover damages at the following rates if an ESIC payment is missing or delayed:

| Period of Delay | Damages in % Per Annum |

| Less than 2 months | 5% |

| 2 to 4 months | 10% |

| 4 to 6 months | 15% |

| 6 months and above | 25% |

You should exercise caution because late ESIC contributions may result in penalties. Ensure that your company pays sufficiently in advance to prevent any unwanted surprises.

Processing a Failed Transaction

The following factors may cause the transaction to fail: –

- Issues with connectivity

- Lack of funds

- The user’s password and login ID are gone.

- The ESIC website does not redirect the online SBI payment page. The transaction failed because of a broken connection, etc. You can retry the unsuccessful transaction by selecting the “Online Challan Double” link.

- To proceed with the unsuccessful transaction, type the Challan number into the text field and press the submit button.

- The user can now use SBI online banking by clicking “make payment” after the Challan number and amount have been presented. The SBI online banking payment site will be displayed once you click the “make payment” notification.

What are the Reasons for the Failed Transaction?

There can be many reasons for failed transactions. That includes:

- Lack of funds in the bank account

- Connectivity issues

- Incorrect Login details

- Server issues

Printing/ Re-Printing the Challan

- For this step, you must again log in to the ESIC website using this link: https://www.esic.in. After logging in, a window containing several hyperlinks categorized under several sections will appear.

- The last option under “Monthly Contributions” is “Online Challan Double Verification,” which you need to choose.

- After clicking the link, you will be taken to the Challan Double Verification website. Enter the Employer’s code and the Challan number.

- Once the data has been submitted, you can click submit to view the entire transaction summary. From this point on, you can save it or print it.

What are the Returns/ Reports to be Submitted by the Employer?

The Employer must send in the following reports. They are as follows:

Accident Report: The branch office must receive reports of any accidents.

Report on Abstention Verification: This will be sent to the branch office whenever the branch manager requests it.

It is necessary to turn in attendance, wage, and bookkeeping records.

ESIC Payment Due Date

ESI payments are due on the fifteenth day after the end of the month. Employers must deposit the money by this date, including through ESIC online payment, to avoid penalty under the plan’s conditions.

How does ESIC Work?

The ESI Scheme was first introduced in 1952 in Delhi and Kanpur’s industrial hubs. There has been no turning back since then regarding its demographic coverage and geographic reach. In keeping with the industrialization process, the Scheme is currently being implemented in more than 843 locations across 33 States and Union Territories.

The Act benefits about 2.13 crore insured individuals and family units, which is currently in effect for about 7.83 lakh enterprises and institutions nationwide. The total number of beneficiaries is presently around 8.28 crores. Businesses can safeguard the health of their employees with ESI registration.

Features and Benefits of ESIC Online Payment

The following list includes the numerous attributes and advantages of ESIC online payment:

- Online ESIC payments are required for both employers and employees.

- Indian citizens no longer need to attend government centres to submit their challan payments online.

- Employers deduct 4.75% of total earnings, and employees contribute 1.75%.

- SBI account holders with access to net banking capabilities can make ESIC payments online.

- This system improvement improves transparency while saving time and effort.

ESIC Payments Monthly Contribution Rate

Specific parameters determine the monthly contribution rate of ESIC. Currently, the company must contribute 4.75% of wages provided to employees in each paycheck period, while the employee’s contribution rate is set at 1.75% of salary. A lower contribution rate applies to newly established areas or businesses for the first two years. Employers contribute 3% on behalf of the employees during this time, while employees contribute 1% of their wages.

ESIC 2.0

On July 20, 2015, the Honourable Prime Minister, Shri Narendra Modi, introduced several Health reform initiatives of ESIC at Vigyan Bhawan, New Delhi. Online access to the Electronic Health Record of ESI Beneficiaries (Insured Persons and their families) is part of the Health Reforms Agenda of ESIC.

The Final Words

ESIC (Employees’ State Insurance Corporation) is an organisation that oversees the Employees’ State Insurance programme. This programme revolves around offering social security and health insurance to Indian workers. We hope you’ve got a fair idea about the ESIC portal. For more insightful writeups, keep reading our blogs.

Frequently Asked Questions

What is the ESI Scheme?

The Employees' State Insurance Scheme of India is a multifaceted social security programme designed to protect “employees” in the organised sector from illness, pregnancy, disability, and death resulting from work-related injuries. It also offers medical care to covered employees and their families.

Are there any medical advantages that ESIC extends?

Yes, insured people are eligible for medical benefits under the ESIC plan. Treatment, specialised advice, hospital stays, medical attendance, etc., are all examples of medical help. Families have two types of medical benefits available: comprehensive medical care and spent medical care.

How does the Scheme help the employees?

Under the ESI Act of 1948, employees are entitled to full medical care during the duration of their incapacity and restoration of their health and ability to work. The Act offers monetary support to make up for lost income from time spent away from work due to illness, pregnancy, or work-related injuries.

How much is the monthly payment of ESIC?

The Employer's contribution rate is 3.25% of the earnings paid to the employees throughout the period, while the employee's contribution rate is 0.75% of the wages.

What is the maximum salary limit for ESI?

A maximum salary of Rs 21,000 per month is required for ESI eligibility. Under the ESI plan, employees making less than this threshold are entitled to a range of benefits, including medical, sickness, maternity, and disablement benefits.

How is ESI calculated in salary?

The monthly gross salary of an employee is used to compute ESI. The Employer deducts a certain proportion of the employee's pay from their wage, and both the Employer and the employee contribute to ESI.

What happens after the due date of ESIC?

The equal amount will increase the assessed income.

Can the ESI amount be taken out?

No, we are unable to take money out of ESI.

What is the minimum number of employees for ESIC?

Ten or more people are required as minimum employees for ESIC.

Will I be penalised if I don't make the ESIC payment on time?

Yes, you will be assessed interest at 12% annually for each day you fail to pay the contribution amount.

What is the employer code number?

The employer code number is a 17-digit number provided to any factory or facility registered under the Act's terms. The Employer must supply the code number to complete the ESIC online payment.

Does ESIC provide any medical benefits?

The insured and their family would receive medical benefits from ESIC. They will receive a comprehensive spectrum of medical, surgical, and obstetric care, including outpatient and inpatient care, medication supplies, prenatal and postnatal care, super speciality consultations, ambulance services, etc.

What is the deadline for ESIC payment?

The fifteenth day of each month is the deadline for monthly ESIC payments.

How to check ESIC payment status?

Use these procedures to see the status of your ESIC payment:

Step 1: Go to the “payment” area of the ESIC portal after logging in.

Step 2: Enter pertinent information, such as the payment date or the Challan number.

Step 3: View the payment status and confirmation message for successful transactions.

Read our article EPF Registration For Private Limited Company