To run a successful business, the company needs to have sustainable working capital. Sustainable working capital offers a company with the flexibility to expand and enhance its operations, improve liquidity and respond to demanding economic conditions. The goal of working capital management is to make sure that a company is able to continue its operations and satisfy both maturing short-term debt and upcoming operational expenses. Managing a working capital involves managing inventories, accounts receivable, accounts payable and cash. In this blog, we will focus on the importance of Accounts Receivable in managing sustainable working capital.

What is Accounts Receivable?

A company sells its goods and services both in cash and credit. When a firm extends the credit to the customer, the sale is said to be done when the invoice is generated but usually, a time period is provided to the customers for the payment of the due amount. This process of conducting business on credit terms gives rise to Accounts Receivable (AR) in the financial statements. Account Receivables (AR) are considered as current assets on the balance sheet. The amount of accounts receivable depends on the line of credit which the customer enjoys from the company.

Let us understand what Accounts Receivable is through an example:

Let’s say you own a business of guitars. A customer gives you an order of 20 guitars. The amount payable for 20 guitars is 2 lakh rupees. Now, when you generate the invoice for that amount, the sale is recorded. However, to make the payment, you extend the credit period of 30 days to the customer. Now, for the next 30 days, till you receive the payment, the amount of Rs 2 lakhs becomes your account receivable. If the customer isn’t able to pay the amount on scheduled time, you can charge a late fee. Once the payment is received the cash segment in the balance sheet will increase by Rs 2 lakhs and the accounts receivable will be decreased by the same amount.

Importance of Accounts Receivable

Accounts Receivable services measures the money that customers owe to a firm for goods and services already provided. They are considered as future assets that can be brought into use whenever needed. However, for accounts receivable to become an asset, the process of converting your accounts receivable into cash should be proactively optimized. Improving accounts receivable helps businesses in freeing up their cash as early as possible and eventually strengthens their working capital. Since accounts receivables form a major part of a firm’s asset, it generates cash-in-flow in the books of the organization. Optimizing Accounts receivable can drastically enhance the aspects of the business. It prevents the capital from going to waste, which in turn increases liquidity. This eventually allows businesses to reduce debt, fund growth and helps them to expand their horizons.

Accounts Receivable Pitfalls

- Often business owners don’t pay much attention to Accounts Receivable which ultimately affects their business negatively. Businesses often prioritize sales and to increase the number of sales, they offer discounts and tend to ignore payment terms. And eventually, such businesses end up providing customers with free financing.

- Extending credit to unqualified customers and then not keeping track of it also affects the account receivable process. Poor accounts receivable management creates a kind of ripple effect that virtually affects every aspect of running a company.

- If businesses fail to keep a proper track of all the due dates of the payments to be received and much attention is not paid to the accuracy of bills and invoices, this may eventually create serious issues for such businesses.

Read our article: What are the Basic Financial Statements?

Tips to Manage Accounts Receivable Effectively

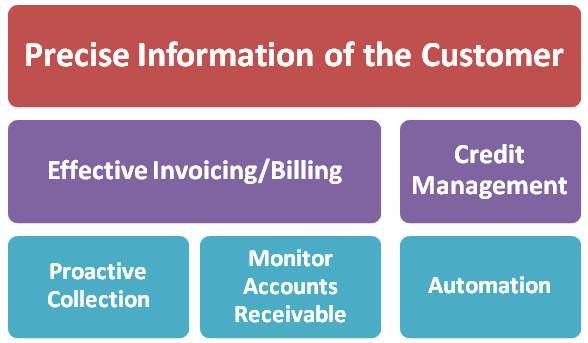

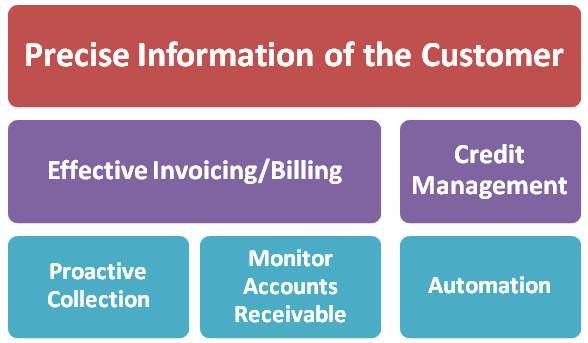

Following are some of the tips you can follow to manage Accounts Receivable process effectively:

- Precise Information of the Customer: Details of the customer to whom credit has been extended by the business should be maintained accurately. Details of their account, address, everything should be up to date. Accounts of customers should be audited regularly to check unusual payment terms, credit limit etc. Any change in the information of the customer should be documented correctly. If information isn’t added correctly, it slows down the receivables.

- Effective Invoicing/ Billing process: The billing and invoicing of customers should be precise and accurate. Although billing seems fairly easy and straightforward, however, many companies often struggle in this area. Some of the common errors made in invoices are related to units of measure, price or incorrect information of the customer. Many fail to generate invoices in time. To solve these issues, an effective billing/invoicing process should be established.

- Credit Management: Just to increase the sales, the credit line shouldn’t be extended without paying a second thought. This strategy often backfires in the long run and is one of the potential problems that arise without proper credit management.

- Monitor Accounts Receivable: Once the invoicing is complete, it is the responsibility of the accounting officer to ensure that the payment is deposited on time. The officer also issues monthly statements to its clients, which provides hi the information about the amount owed.

- Proactive Collection: The collection of money should be the priority of any business owner to maintain a positive cash-flow in the company. Businesses should resort to a robust accounting process to make the collection process more proactive. Other than this it should be ensured that the discounts offered should benefit the company and are implemented correctly.

- Automation: Automation has changed the way the business world operates today. It has made things more simple and cost-effective. The initial cost to purchase good software may be high, but once everything gets set up, the eventual results are extremely positive. Automation simplifies the process of accounts receivable in many ways such as sending reminders to customers for due payment etc. Moreover, Automation reduces the need for workforce and at the same time, makes payments more secure and quick.

Take Away

Businesses often prioritize sales and don’t emphasize much on Accounts Receivable. However, poor AR practices cause various problems for businesses. Poor AR practices eventually suck time, money and productivity out of business. Therefore, it is very important for any business owner to pay attention to accounts receivable as they play an essential role in managing the working capital of the business.

Read our article: How to Effectively Improve Cash Flow Management in Business?