In order to start an NGO in India, an individual or a corporation/business/entity must be sure about the purpose of starting an NGO and how it works as well. Usually, people set up an NGO with an endeavour to fulfil all the basic requirements of the impoverished people striving to survive anyhow in the marginalized areas of any region.

An Overview on NGO in India

Running an NGO is for a noble cause. By looking at the disadvantaged people craving for survival amidst the hardships and challenges of life, we must say that commencing an NGO has become the need of the minute in a country like India, which is in the development mode. The soul of the NGOs operating in India lies in bringing a group of volunteers together at a single platform and put combined efforts in the direction of upliftment as well as the welfare of the society.

The process of running an NGO in India is similar to the process of running a company up to a great extent, but if you want to start an NGO in India, you must embrace the transparency factor. Priority should be serving the society above profit motive or anything else. The desire to live a selfless life is something that comes from within. In the last few decades, many volunteers came forward to establish and sustain Non-government organizations in India.

The first and foremost thing that demands consideration to start an NGO in India is the following all the legal procedures and meeting the requirements. The clarity in accounts, as well as paperwork, would make the process smoother. In this write-up, we are covering the point-by-point steps to start an NGO in India.

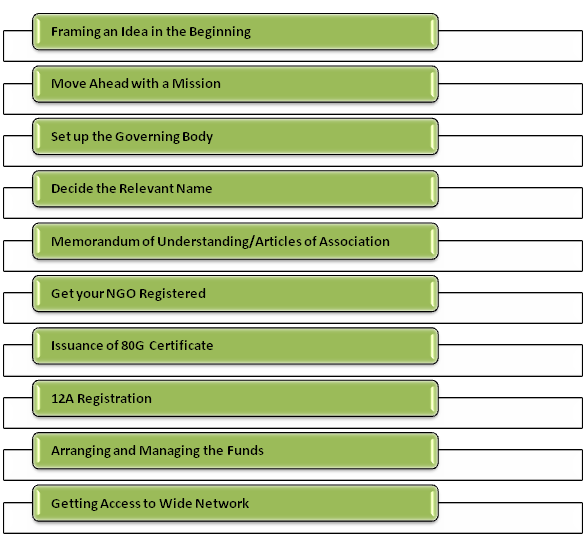

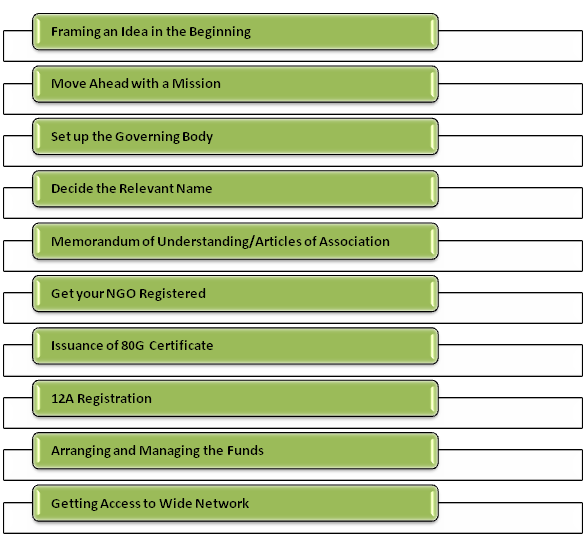

Point-by-Point Steps to Start an NGO in India

If you are keen to start an NGO in India, you need to get the approach right. Given below are the mandatory steps that would help you to start an NGO in India-

Framing an Idea in the Beginning

Setting up an NGO in India requires the creation of a purposeful idea at the scratch level. Only financial means are not enough, backing your idea with active community participation, firm moral support, and thorough commitment is also essential. It would be best if you make a proper analysis and make yourself familiarize with your interests and internal thought process regarding the charitable works. Keep yourself ready with the plan concerning the field of social and charitable work[1] where you would like to invest your energy.

Move Ahead with a Mission

Your mission or cause must be apparent to start an NGO in India. NGOs are social-service oriented organizations that endeavour to create a society where a part of the population craving for basic necessities must get all the requirements to survive and defeat poverty with a considerable margin. From the point of the scratch level to starting up, non-governmental organizations keep maintaining the integrated approach.

In our country, people are coming to blows with national issues like mid-day meals, child labour, human trafficking, physical assault and sexual harassment, etc.Draft a targeted as well as short statement revealing your mission. Besides this, explain your objectives, long-term goals, along with the target group. Pen down those issues that NGOs will be looking after and recognize the entire vision.

Set up the Governing Body

When it comes to governance of NGO and its activities, the Board of Directors/Members will be taking charge. It’s important to have those people at the governing level who can catch your vision and mission and who can cultivate the desire in the heart to serve the people living in marginalized communities. The government expects you to disclose these names and the accomplishments of your NGO lies on the shoulders of the board members. Thus, getting the best men on the board is crucial. In addition to this, you need to take the support of writers, lawyers, financial advisors, and legal experts as well.

Decide the Relevant Name

You must confirm a name for your NGO. The name must be short as well as appropriate. Various NGOs have got their names after families, people, and also the causes. One more thing, the name must not resemble the name of any Board, Ministry, registered NGO or company, or any government regulatory body.

Read our article:Tax Exemption for NGOs: Section 12A & 80G

Memorandum of Understanding/Articles of Association

The legal essentials to start an NGO in India are to document a Memorandum of Association, trust deed/Rules&Regulations. It includes the name along with the address of the NGO, mission and vision document, HR and staff information along with the administrationdetails. The preparation of Memorandum should be in the conformity with acceptable parameters, pattern and process that are mandatory for registration and similar nature of procedures. Before submitting the application for NGO registration, it is vital to gain insights on the bylaws.

Get your NGO Registered

After the submission process of required fees get completed, and you are all set with your documents, you must get your NGO registered under the three Acts mentioned below-

- Indian Trusts Act– In the case of charitable trust, there is a requirement of at least two people. There is no maximum limit.

- Societies Registration Act– In society, minimum of seven persons can become the members, and they can enter into a contract as well.

- Companies Act– A non-profit organization can take further steps for getting itself registered under the section-8 of Companies Act with the Registrar of Companies.

Issuance of 80G Certificate

Income Tax Department is the authorized body to provide 80G certificate to NGOs or Non-profit making organizations. 80G certificate helps in promoting the donors to immerse themselves in donating more funds in terms of charity to charitable institutions/organizations. By making a donation to an NGO, donors can avail the benefit of tax exemption on their charity. Thus, applying for 80G registration is mandatory to claim tax exemptions made for the donations to NGO. Contributions made to relief fund can get claimed as a deduction under Section 80G of the Income Tax Act.

Issuance of 12A Registration

Income Tax Department grants 12A registration to trusts and non-profit making organizations. Organizations having their registration under Section12A enjoy exemption from paying taxes on their surplus income. All non-profit making entities can take advantage of 12A registration facility. Therefore, it’s crucial for them to be aware of Section 12A of the Income Tax Act. This registration acts as legal proof of the NGO existence.

Arranging and Managing the Funds

After NGO registration, managing and collecting the funds for running an NGO is mandatory. Trust is entitled to receive donations. Moreover, International remittance is also possible but with the limitations foisted by the Foreign Contribution Regulation Act. All incomes and financial benefits of the organization must get utilized in boosting the motives of the organization.

Getting Access to Wide Network

NGOs need to expand their network,and establish healthy connections with various NGOs,government agencies, and professionals as well as media houses. Furthermore, they should build authentic partnerships. Things that act as the driving force for NGOs are the connections and collaborations.

Wrapping Up

NGOs are beneficial to people from diverse realms of society. If you plan to start an NGO in India, then you must follow the step-by-step guide mentioned above in the article. Besides this, obtaining section 80G and 12A registration is beneficial for the individuals as well as the organizations. At Corpbiz, we would help you in acquiring 80G registration and 12A registration, along with support in other documentation process and give you the wings to start an NGO in India.

Read our article:Audit of Charitable trust or NGO under section 12A (b)