In India, the financial service sector includes not only commercial banks but also the Non-Banking Financial Companies (NBFCs). The banks are not the only source of lending and borrowing funds in our country. NBFCs are an alternative for the people who do not want to wait in the lines of banks to borrow money for setting up business activities. The NBFCs provide a vast range of services like chit-funds, loans, etc. and the function of NBFCs are entirely different from banks. The developing countries like India, where there is a constant need for short-term finances for the people living in rural areas, NBFCs are the most efficient method for lending and borrowing finances. In this article, we will discuss the step by step procedure of NBFC Registration in India.

What are NBFCs?

NBFCs or Non-Banking Financial Companies are Companies incorporated under Companies Act, 2013[1]. These companies are engaged in business activities like loans, advances, hire-purchase, debt, equity, currency exchange, financing assets, P2P lending, and many more. NBFCs carry on their operations as per guidelines specified by the Reserve Bank of India (RBI).

Section 45-I(c) of the Reserve Bank of India Act, 1934, provides for a non-banking Company which is carrying on a business of financial institution will be an NBFC. The Ministry of Corporate Affairs also governs and manages the functions of the NBFCs.

What are the Roles and Functions of NBFCs?

The roles and functions of NBFCs are as follows:

- Increase and help in wealth creation;

- Provide finances to economically weaker sections of society;

- Development of specific sectors like infrastructure;

- Generating Substantial Employment;

- Provide specialized credit and longtime audit;

- Helps in the economic development of the country;

- Helps in financial market development;

- Contribution to State exchequer.

What are the different types of NBFCs?

The categorization of NBFCs are done in the following heads:

Basis of Liability

The categorization of NBFCs in terms of the liability is as follows:

- Deposit Accepting NBFCs(NBFCs-D) (Deposit Taking)

- Non-Deposit Accepting NBFCs (NBFCs-ND) (Non-Deposit Taking)

The Non-Deposit Accepting NBFCs are further divided on the basis of size. The types of NBFCs based on size are as follows:

- Systematically Important NBFCs [NBFCs-ND-SI]

- Non-Deposit Holding NBFCs [NBFCs-ND]

Basis of Activity

On the basis of nature of the activity, NBFCs carry out the types of different NBFCs are as follows:

- Investment Company (IC)

- Housing Company

- Micro Finance Company (MFI)

- Asset Finance Company (AFC)

- Mortgage Guarantee Company (MGC)

- Loan Company (LC)

- Infrastructure Finance Company (IFC)

- Core Investment Company (CIC)

Which Companies do not require registration from RBI?

The companies which do not require Registration of RBI are as follows:

- Housing Finance Companies (regulated by the National Housing Bank);

- Companies engaged in Stock Broking (regulated by Securities and Exchange Board of India);

- Core Investment Company whose assets are less than 100 crore rupees (regulated by Securities and Exchange Board of India);

- Nidhi Companies (regulated by Ministry of Corporate Affairs {MCA});

- Chit Fund Companies (regulated by respective State Governments);

- Companies engaged in transactions of Venture Capital (regulated by Securities and Exchange Board of India);

- Merchant Banking Companies (regulated by Securities and Exchange Board of India);

- Insurance Companies (whose certificate of registration is issued by the Insurance and Regulatory Development Authority of India {IRDA}).

Read our article:Documents Required for NBFC Registration

What are the differences between a Bank and NBFCs?

NBFCs can lend and invest money, just like traditional banks. The activities of banks and NBFCs are moreover similar. The financial intermediaries are regulated by the Companies Act, 2013, and the Banking Regulation Act, 1949. The control of both the financial intermediaries is under the Reserve Bank of India. The difference between financial intermediaries is as follows:

- NBFCs cannot accept demand deposits like banks;

- NBFCs cannot issue cheques on itself and do not form part of the settlement and payment system;

- The facility of deposit insurance provided by Deposit Insurance and Credit Guarantee Corporation (DICGC)is not available to the NBFCs depositors.

What are the basic requirements to get NBFC Registration from RBI?

NBFCs incorporated under the Companies Act, 2013, or the Companies Act, 1956, willing to start a non-banking finance business should have to comply with some basic requirements for getting RBI registration. The basic requirements for getting NBFC Registration from RBI are as follows:

- NBFC should be a registered company under the Companies Act, 2013;

- NBFC should have the minimum net owned fund of 2 crore Rupees (except for NBFC-Factors, NBFC-MFIs, CIC).

The net owned funds can be calculated from the balance sheet of the firm, which is last audited. Capital Reserve, Paid-up Equity Capital, Share Premium Account Balance, Free Reserves constitutes the total owned funds of a firm.

What documents are required for NBFC Registration?

The documents required for NBFC Registration are as follows:

- The certificate of Incorporation or the Certificate of Commencement of business of Company;

- The details of the management of the Company with the brochure of the Company;

- A copy of the PAN card of Company;

- A copy of the Corporate Identity Number (CIN) of Company;

- All documents related to address of office and location of office;

- A true certified copy of Memorandum of Association (MoA) of Company;

- A true certified copy of Articles of Association (AoA) of Company;

- The credit reports of Directors of Company;

- The detailed list of Directors profile, separately filled and signed by each Director;

- A copy of Board Resolution certifying that the Company has stopped or carried out any NBFC activity and will not carry on any NBFC activity until Registration from RBI is granted;

- A copy of income tax returns and bank statement which should be self-certified;

- The detailed information of the bank accounts, loans, credits, balances, etc.;

- A true certified copy of Board Resolution passed on “Fair Practices Code”;

- A certificate by Statutory Auditor stating that the Company does not hold any public deposit and does not accept such deposits;

- A certificate from Statutory Auditor specifying the owned funds of the Company as on the date of application;

- CIBIL data of Directors of Company;

- A copy of the document with details of the source of startup capital of Company;

- The balance sheet audited and profit and loss statement along with Auditors and Director’s report of the 3 preceding years of the Company;

- The detailed information of the next 3 years’ future plan of the Company along with the projection of cash flow statement, income statement, and balance sheet.

What are the guidelines of RBI for NBFC Registration in India?

The NBFCs function is regulated by the Reserve Bank of India (RBI). The NBFCs have to abide by the guidelines provided by the Reserve Bank of India (RBI). The guidelines of RBI for NBFC Registration are as follows:

- The amount which is taken by NBFCs, the repayment of such amount will not be guaranteed by Reserve Bank of India (RBI);

- NBFCs should not accept demand deposits from public investors or depositors;

- The interest rate charged by the Company should not be more than the rate prescribed by the Reserve Bank of India (RBI);

- To make settlements and payments the NBFCs cannot issue cheques;

- The record of statutory return on deposits should be filed by Company every year in Form NBS-1;

- The Company should file a quarterly return on the liquid assets in Form NBS-3;

- The Company should submit a quarterly return on prudential norms in Form NBS-2;

- Every year the audited balance sheet of Company should be submitted;

- The credit ratings every 6 months should be submitted to Reserve Bank of India (RBI);

- The depositors cannot avail the security facility of Deposit Insurance and Credit Guarantee Corporation (DICGC);

- No additional benefits, gifts, or extra incentives will be provided to the depositors or customers of NBFCs;

- The Company can take public deposits for a minimum period of 12 months. The maximum tenure of public deposits can be 60 months. The Company cannot accept deposits repayable on demand;

- The NBFCs which matches and are duly rated as per the Minimum Investment Grade Credit (MIGC) rating will be eligible for accepting conditional deposits from public depositors;

- The Company should maintain a minimum of 15% of the public deposits in its liquid assets.

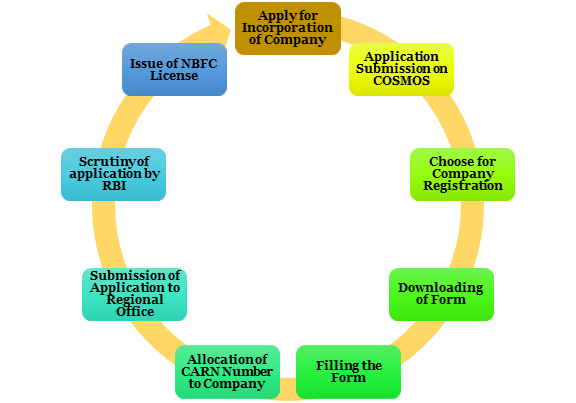

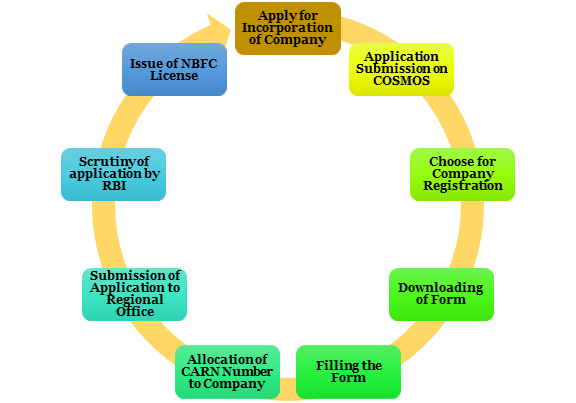

What is the procedure of NBFC Registration in India?

The step by step procedure of NBFC Registration is as follows:

Apply for Incorporation of Company

- The applicant has to register under the Companies Act, 2013, as a Public Company or a Private Company. The Company must be registered with the Ministry of Corporate Affairs (MCA) under the Companies Act, 2013.

Application Submission on COSMOS

- The applicant should submit the application on the RBI website known as COSMOS (Cluster of Systems of Metadata for Official Statistics).

- Along with the online application form, a physical copy of the application with the required documents is required to be submitted by the applicant to the Regional Office of the Reserve Bank of India (RBI).

Choose for Company Registration

- The applicant, after having access to the RBI website, the login page of the COSMOS (Cluster of Systems of Metadata for Official Statistics) application, will ask for clicking on the Company Registration tab.

- The applicant should click on the Company Registration of COSMOS (Cluster of Systems of Metadata for Official Statistics) application and should proceed further.

Downloading of Form

- A window will appear displaying an Excel application form that is available to be downloaded.

- The applicant should download the appropriate application form, which is NBFC, from the website of COSMOS (Cluster of Systems of Metadata for Official Statistics).

Filling the Form

- In the excel form, the applicant needs to fill the correct name of the Regional Office in the provided filed “C-8” of “Annex-I Identification Particulars.”

Allocation of CARN Number to Company

- After the submission of the form by the applicant, a Company Application Reference Number (CARN) will be allocated for the Certificate of Recognition (CoR), which was filed online on the website.

Submission of Application to Regional Office

- Once the applicant receives the CARN number, the physical application with all the supporting documents required should be submitted to the Regional Office of Reserve Bank of India (RBI).

Scrutiny of the Application by RBI

- The RBI will scrutinize the application form and the supporting documents and will send it to the head office.

Issue of NBFC License

- The application filed is correct, the supporting documents are complete, and the records are clean, the head office of Reserve Bank of India (RBI) will issue NBFC License.

- The NBFC License will be issued within 90 days by the head office.

- The applicant can track the status of the application by entering the acknowledgment number.

What are the advantages of NBFC Registration?

The advantages of NBFC Registration are as follows:

Low Time and Cost

- As compared to small banks, the Registration of NBFCs is considered an easy task. An excessive amount of cost and time is required for opening a bank; on the other hand, it is not in the case of NBFCs.

Easy Registration

- The NBFC Registration is easy as compared to opening a bank. If one has a good consultant with good experience, then it is an easier task to get NBFC Registration.

Easy Recovery of Loan.

- NBFCs are systematic and offer a considerable small amount of loans to the borrowers. The borrowers quickly return such small amounts of loans in the prescribed time, hence making it convenient for the lenders.

Industrial Growth

- Nowadays, everyone needs an easy source of funding for their new businesses. NBFCs provide easy loans in a short time to people setting up new businesses in a short time. Hence, this led to the formation of new Companies leading to overall industrial growth in the country.

Conclusion

NBFCs are companies which match with traditional banks to some extent. Due to some restrictions and dissimilarities, NBFCs cannot carry on all the work like other conventional banks; hence this is what sets the NBFCs apart. The NBFC Registration process in itself is a daunting task as approval of the Reserve Bank of India (RBI) is needed. The process of NBFC Registration is long-lasting and time-consuming. Therefore, if you are willing to register NBFC, then you require an experienced consultant who has a good understanding of NBFC Registration and deals with RBI. We at Corpbiz have experienced professionals to help you with the process of registration. Our professionals will guide you and assist you in the process of NBFC Registration. The professionals will ensure the timely and successful completion of your work.

Read our article:Future of NBFCs in India – A Reality Check