Tax Deducted at Source (TDS) is one of the significant concerns for taxpayers complying the Income Tax Act. Due to the outbreak of covid-19 pandemic the Government has provided lower TDS Return rates in The Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020.

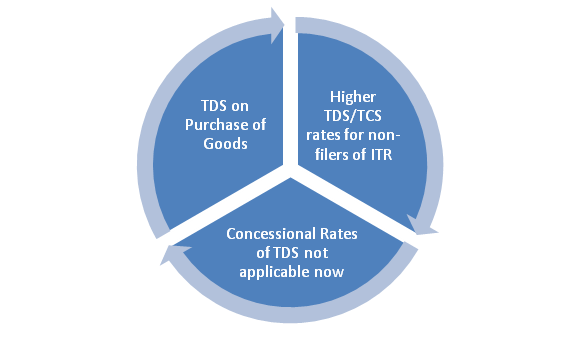

In Budget 2021, the major changes have been made by Introducing New Section in both TDS & TCS for Income Tax Returns (ITR) Non-Filer and TDS on Purchase of Goods with effect from 01st July, 2021.

The Central government has dropped the rate of the tax deducted at source (TDS) and the rate of tax collected at source (TCS) by 25 per cent on non-salaried payments which is effective from May 14, 2020, and until March 31, 2021. The government has undertaken this decision by lowering tax rates so as to give additional liquidity[1] to people.

Overview of TDS Return Filing

TDS return filing shows every tax collection by the Income Tax Department of India, whenever you make any transaction or purchases. It has information such as PAN, TAN particulars of both, the Deductor and the deductee, the tax paid to the government, and TDS challan details, etc.

Any bodies or any individual which generally involves them self in the payment of salary, contracts, interests, professionals, dividends, etc., making the TDS deductions rendering to the slabs they fall into, which are pre-decided by the management.

Here we have delivered complete notifications related to the Income Tax and TDS provisions as per the authorized government laws. We embrace all the latest updates in Income Tax and TDS, news, amendments, and circulars as on the government gateway for your knowledge.

Highlights of TDS Rate changes

What are the Points to Be Taken into Consideration by the Person while Deducting the Tax at Source?

- The first and foremost step is to procure the Tax Deduction Account Number (TAN). TAN has to be mentioned in all the related documents and communication related to the TDS.

- The TDS statements must be prepared by means of Return Preparation Utility (RPU) and must be validated by using File Validation Utility (FVU)

- A valid registered DSC for e-filing is a mandate for the taxpayer to have while filing he can upload his DSC.

- The principal bank account or details of demat account ought to be provided or the PAN of principal contact’s have to be linked with the Aadhaar if he wish to upload using EVC.

- The amount deducted under the TDS returns by the payer has to be according to the slabs decided by the Income Tax Department and must be filed within the specific timelines to avert the penalty. The deductee receives the TDS certificates for every TDS return filing over every period.

Due Dates for E-Filing TDS Returns of FY 2020-21

| Quarter | Quarter Period | Last Date of Filing | ||

| 1st Quarter | 1st April to 30th June | 31st March 2021 | ||

| 2nd Quarter | 1st July to 30th September | 31st March 2021 | ||

| 3rd Quarter | 1st October to 31st December | 31st Jan 2021 | ||

| 4th Quarter | 1st January to 31st March | 31st May 2021 |

Tax deducted Interest for late deposit

- A fine of Rs 200 per day shall be levied under Section 234 E, until the return is filed. The fine shall be paid every day on delaying until the amount of fine becomes equal to the amount supposed to pay as TDS.

- Under section 201A the Interest shall be charged in respect of non-deduction of tax at source which is either in whole or in part – then the interest reduced subject to TDS/TCS amount due to Covid -19 is 1% per month from the date on which tax is deductible to the date on which tax is actually deducted.

- In case after deduction of tax and non payment of tax either in whole or in part – then the interest reduced subject to TDS/TCS amount is 1.5% per month and 0.75% per month or part of month for delay in remittance beyond due date from the date of deduction to the date of payment.

What is the TDS Rate Chart for Assessment year 2021-22?

- Honorable Finance Minister has stated in the press release that tax collected at source rate and the TDS rates for all ‘non-salaried’ payment to residents will be concentrated and reduced by 25 % of the specified rates for the outstanding period of Financial Year 2020-21. This will deliver liquidity up until the amount of Rs 50, 000 Cr.

- Afterward, this press release has raised many doubts regarding TDS rates as well as sections in which this reduction will be relevant. However, amendments taken place by Finance Budget, 2020 includes two New TDS Sections.

- Those are Section 194K and Section 194O. These sections provide TDS on ‘Mutual Fund Income’ and TDS on ‘E-Commerce Transactions’. At hand, there were also deviations in few existing sections of TDS which contains amendments in Section 194J by which TDS on ‘Technical Services’. It has also been reduced to 2%.

TDS Rate Chart for FY 2021-2022 (AY 2022-2023) including Budget 2021 Amendments

| Section | Nature of Payment | Threshold | TDS Rate | Remarks |

| 192 | Salary | Taxable Income that is liable to Tax | Rate of Normal Slab (or) Rate of New Tax Regime Slab as choosen by employee | For salaried employees- Option to choose between new tax slab regime and the old one |

| 192A | Payment that is taxable in the employees hands of the accumulated balance of provident fund | 50,000 | 10% | – |

| 193 | Interest on the securities | 2,500 | 10% | – |

| 194 | Dividend | 5,000 | 10% | Budget 2021 amendment provides to amend section 194 second proviso of the Act further |

| Provides that section 194 i.e. TDS on dividend shall not apply to income dividend credited to a business trust by a special purpose or dividend payment to other person as notified. This signifies that no TDS to be deducted to AIF Category III also. | ||||

| 194A | Interest on Bank Deposit or P. O. Deposit or Deposit on Banking Co-Society (Interest except “Interest on securities” ) | |||

| a) Senior Citizen | 50,000 | 10% | – | |

| b) Others | 40,000 | 10% | – | |

| 194A | Interest i.e. other than “Interest on securities” but shall exclude Bank Deposit or P. O. Or Deposit or Banking | 5,000 | 10% | – |

| Co-Society Deposit | ||||

| 194B | Winnings from card games lotteries, puzzles, crosswords and other games | 10,000 | 30% | – |

| 194BB | Winning from Horse Race | 10,000 | 30% | – |

| 194C | Payment given to contractor or sub-contractor | sole Transaction: 30,000 & cumulative of Transactions: 1,00,000 | – | |

| a) HUF/ Individuals | 1% | – | ||

| b) Others | 2% | – | ||

| 194D | Insurance commission | |||

| a) Individuals | 15,000 | 5% | – | |

| b) Companies | 15,000 | 10% | – | |

| 194DA | Life insurance policy Payment, the tax shall be deducted on the income amount provided in insurance pay-out | 1,00,000 | 5% | – |

| 194E | Payment to resident sportsmen and sports to non- association | – | 20% | The rate of TDS |

| be increased by surcharge and Health & Education cess. | ||||

| 194EE | Payment respecting deposit under scheme of National Savings | 2,500 | 10% | – |

| 194F | Payment by Mutual Fund or Unit Trust of India on repurchase of unit | – | 20% | – |

| 194G | Sale of lottery tickets Commission | 15,000 | 5% | – |

| 194H | Brokerage or Commission | 15,000 | 5% | – |

| 194-I | Rent: | |||

| (a) Plant & Machinery | 2,40,000 | 2% | – | |

| (b) Land or building or any furniture fitting | 2,40,000 | 10% | – | |

| 194-IA | Payment on transfer of certain immovable property except agricultural land | 50 Lakh | 1% | – |

| 194-IB | Rent Payment by individual or HUF not liable to tax audit | 50,000 per month | 5% | – |

| 194-IC | Joint Development Agreements Payment of monetary consideration | – | 10% | – |

| 194J | Fees for technical services or professional : | |||

| i) technical services sum paid or fees payable | 30,000 | 2% | – | |

| ii) royalty sum paid in the nature of consideration for sale, circulation or display of cinematographic films; | 30,000 | 2% | – | |

| iii) Any other sum | 30,000 | 10% | – | |

| 194K | Income payable to resident person in respect of units | – | 10% | – |

| 194LA | Compensation Payment on acquisition of immovable property | 2,50,000 | 10% | – |

| 194LB | Payment to Non Resident – interest on infrastructure debt fund | – | 5% | The TDS rate shall be increased by surcharge and Education & Health cess. |

| 194LBA(1) | Business trust shall deduct tax | – | 10% | – |

| 194LBB | Payment of Investment fund income to a unit holder [except income exempt under Section 10(23FBB)] | – | 10% | – |

| 194LBC | Income respecting investment made in securitisation trust in | |||

| Explanation of section115 TCA | ||||

| a) HUF/Individuals | – | 25% | – | |

| b) Others | – | 30% | – | |

| 194M | Payment of commission (not insurance commission), brokerage charges, professional fee ,contractual fee, to a person resident by an Individual or a HUF not liable to deduct TDS under section 194C, 194H, or 194J. | 50 Lakh | 5% | – |

| 194N | withdrawal of cash during the previous year from one or more than one account as maintained by a banking company person, co-operative society occupied in business of banking or a P.O | |||

| i) in excess of Rs. 1 crore | 1 Crore | 2% | – | |

| ii) in excess of Rs. 20 lakhs | ||||

| a) On amount withdrawn in cash if the aggregate of the amount of withdrawal exceeds Rs. 20 lakhs during the previous year; | 20 Lakh | 2% | – | |

| b) The amount withdrawn by cash only if the aggregate amount withdrawal > Rs. 1 crore through the preceding year; | 1 Crore | 5% | – | |

| 194-O | The Payment or credit of amount by operator of e-commerce to participant | 5 Lakh | 1% | – |

| 194Q | Purchase of goods (applicable from 01.07.2021) | 50 Lakh | 0.10% | Budget 2021 Update A new section 194Q is inserted to provide deduction of TDS by person paying any sum to resident for purchasal of goods @ 0.1%. |

| 195 | Payment to a Non-resident of any other sum | The rate of TDS shall be increased by applicable surcharge and Health & Education cess. | ||

| a) Income by a Non-resident Indian Citizen – in respect of investment | – | 20% | – | |

| b) Income in Section 115E by long-term capital gains of Indian Citizen Non-resident | – | 10% | – | |

| c) Income under Section 112by long-term capital gains | – | 10% | – | |

| d) Income in Section 112A long-term capital gains | – | 10% | – | |

| e) Income in Section 111A by short-term capital gains | – | 15% | – | |

| f) Any other income of long-term capital gains [except long-term capital gains as given in clauses 10(33), 10(36) and 112A | – | 20% | – | |

| g) Income through interest that is paid by Government or | – | 20% | – | |

| an Indian on moneys borrowed or Government incurred debt, or the foreign currency Indian concern except income of interest provided in Section 194LB or under Section 194LC | ||||

| h) Any other Income | – | 30% | – | |

| 206AB | TDS charged on ITR non-filers at higher rates (applicable rom 01.07.2021) | |||

| 194P | TDS on Senior Citizen above 75 Years | New section 194P will be added |

What are the Steps to Be Followed While Filing the TDS Return?

TDS Return filing forms, which need to be filled to pay the taxes.

- FORM 24Q – It requires you to fill the details regarding the tax deductions at source from salary

- FORM 26Q – This form requires you to mention the details of tax deduction from all the sources except salary

- FORM 27Q– Here you present all the tax deductions from other sources of earning. For example dividend funds, interests from savings or fixed deposit, any sum payable to non-residents, etc.

- FORM 27EQ- It is the statement collected at the source.

What are the Penalties Applicable?

The late filing fee is given under section 234E wherein the deductor shall be liable to pay by way of fee Rs.200 every day till the date he fails to pay TDS. Nevertheless, the penalty shall not exceed the TDS amount for which the statement was requisite to file.

The penalty is given under section 271 H wherein the Assessing Officer has the discretion to direct the person to file the statement of TDS within the due date with a minimum penalty of Rs.10, 000 which can be extended to Rs. 1,00,000. The penalty charged here is in addition to the late filing fee and will also include cases of incorrect filing of TDS returns.

But no penalty will be levied where delay in filing the TDS/TCS return are satisfied where the tax deducted or collected at source or the late filing is paid to the credit of government and the TDS/TCS return is filed before the expiry of one year from the due date.

How to Not Attract the Penalties in TDS Return Filing?

TDS Return Filing has certain due dates, which need to be followed to save you from the fines for the late submission of TDS. If you fail to do so, following the charges and consequences you have to face.

- Late TDS Return Filing Fee as Per Section 234e

- You will be imposed with a fine per day and the late fees shall not exceed the TDS Returns.

- If you have missed the date of filing TDS Return, then you will be asked to pay the fine before filing the TDS Return for Penalty Under Section 271h

- The assessing officers have the power to ask the defaulters to pay the extra fine, apart from late payment fees. This may vary from ten thousand rupees to one lakh rupees. The Penalty will be imposed if you make a mistake while your TDS Return filing or make the wrong entries.

What is meant by TDS on salary and its New Income Tax Rates?

- According to the income tax department, an employee can change the selection of tax arrangement at the time of filing income tax return, and TDS rates will get accustomed accordingly

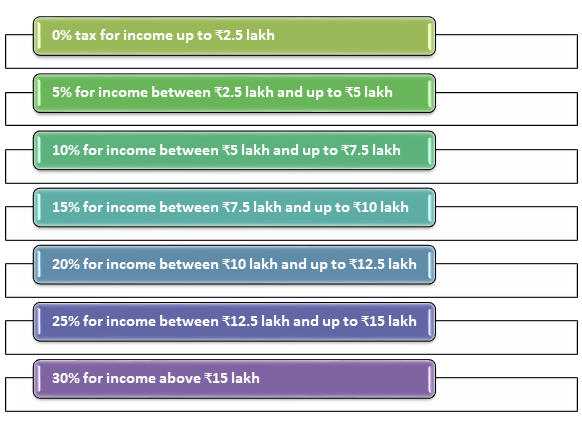

- The income tax department has enshrined new clarifications for those who wish to choose for new tax rate slabs. As publicized in Budget 2020, the lower income tax rates have come into operation from April 1, 2020.

- Giving options to individuals to choose between the two, the old tax slabs will also endure to remain in effect. Tax specialists say that the individual will have to give up on a lot of deductions that could benefit to reduce taxable income even if they get to select the new tax regime or the old one, influenced on a case-to-case basis as under this new lower tax rates.

The Income Tax Rates are as follows:-

Clarifications from Income Tax Department

- Employees who do not have income originated from business or profession, they need to inform their employers. They should state their intention to opt for the new tax regime for determination of deduction tax at source or TDS from regular incomes.

- The employee will remain to be taxed at the older slabs present in the IT Act if such option is not worked out by an employee.

- TDS purpose will be related for the year can’t be modified once it has intimated to the employer about the intent to opt for the new reduced tax rates.

- Moreover, “the deductor” shall calculate his total income and make TDS (tax deducted at source) thereon concerning the provision of ‘Section 115 BAC’ of the Income Tax Act. According to the Income Tax department, if such allusion is not made by the employee, the employer will make TDS without seeing the provision of Section 115 BAC of the Act,”

- Therefore, now, it’s clear that the employee who not having income from business or profession cannot modify the option once exercised for the intention of getting TDS deducted. However, they can always change it at the time of filing the tax return.

What is the Notion of Rate Slabs for NRIs concerning Tax Deducted at Source?

- According to the government announcement, the advantage of lower TDS and TCS rates can only be accessible by resident individuals. It cannot concede the same and not available to non-resident Indian (NRI) taxpayers.

- Central Board of Direct Tax further explained that TDS on the amount paid or credit throughout the period from ‘May 14, 2020, to March 31, 2021’, shall be deducted at the reduced rates. In the same way, the tax on the amount received or deducted during the time frame from 14th May 2020 to 31st March 2021 will be composed at the reduced rates.

- NRIs need to prudently consider the entire Indian income and plot their travel itinerary grounded on the amendment for their period of stay. Point to be noted that, it is a positive change in some essential cases where NRIs can remain staying in India for up to 181 days in the financial year.

- On the other hand the period of stay in India is 120 days or for 365 days or more in preceding 4 years. In case of Indian citizens who are not tax residents of further country are deemed to be tax residents of India, thereby the status would be ‘RNOR’ and henceforth foreign income shall not be chargeable in India.

Conclusion

If you think that, you are running out of time, taking too long, or don’t know how to file your TDS return and want to make sure that you are filing your TDS return in the perfect manner. Then don’t you stress yourself over these tax-related issues. Just pick up your phone and give us a call. Here at CorpBiz, we will help you with the consultation, consolidation of documents required to file the TDS Return from preparation until the end of filing the returns.

Read our article:TDS Returns Filing: Due Dates and Procedure for Filing