Overview of Sale Deed

Sale deed evidences the sale and transfer of ownership of a property, which is a legal contract executed by the seller & the purchaser. A sale deed is an essential Document for both the parties which are registered in accordance with the Registration Act, 1908. It is signed as mentioned in the agreement after both the parties agree with the terms & conditions.

You have to be sure of relevant details while purchasing immovable property, like decided price, any dues associated with it, the total area of the property, the transfer of ownership, etc. You need to know the process of sale deed, the necessary elements, and even the sale deed format for this process's proper execution.

What are the Meanings of Terms in a Sale Deed?

Seller/Transferor

Seller is the one who is keen or willing to sell his property for a price that has current ownership of the property to be sold.

Witness

The person who signs on the sales deed admitting to the fact that the buyer and seller have signed the sale deed is known of him, called as a witness.

Transferee/Purchaser/Buyer

Transferee or Purchaser or Buyer is a person who is keen or willing to buy the property from the seller.

Stamp Duty

A duty levied by the government on the legal acknowledgment of certain Documents. It is a kind of property tax while a property is being sold, which desired to be paid to the respective administration. It is calculated on the market value (whichever is higher) where the stamp duty charges vary from state to state.

Title

The title refers to the proper way of ownership of the property (saying you own a right to something), connoting that you have the right to practice it. However, you can never transfer lawfully more than you own and may be subjected to a partial interest in the property or full.

Since you have a title, you can access the land and possibly modify it as you deemed fit. The title also signifies that you can transfer that concern or slice/share that you own to another person.

Registration Fee

The Registration fee needs to be paid to acquire the property transferred and registered (additional to the stamp duty charges) in your name. The fee is subject to a maximum amount of Rs. 30,000 (either 1% of the market value or the agreement value), which is diverse in different states.

Sale Price

The price of the property agreed upon by both parties, such as the seller and the buyer.

Execution

Sale deed gets executed when all the parties involved like the seller, buyer, and witnesses sign after the preparation of sale deed or make thumb impressions on the Document acknowledging the same.

Registration

The sale deed needs to be registered under the Registration Act of 1908 to make a sale valid. Moreover, this can be done in the presence of both the parties in the sub registrar's office.

Proof of Registration

The certified/attested copy of the registered lease deed can be obtained from the registrar's office with the buyer's name. In the future, it can be act as a 'proof of registration.'

Sale Agreement

It is an agreement that mentions the price agreed upon between buyer and seller for the property and particulars of buyer and seller.

Mode of Payment

It signifies the payment for the transaction made through, like cheque, cash, online transfer, and many more.

What are the Important Elements of the Sale Deed Needs to be Covered?

Explanation of the Property

The sale deed format should contain a complete description of the sale deed, such as the name & address of the buyer and the seller i.e., executing parties.

Considerations of the Sale

If there is any advance paid, Sale price must be agreed between the buyer and the seller and should be mentioned in the sale deed format. The sale deed must include all the information concerning the mode of payment, which may add via the demand draft, cheque, or online transfer, which is also essential in the case to case basis.

Clarification on Period

When passing the title to the buyer, the sale deed format should mention the time. It should get accomplished with all the Documents that must be handed over to the buyer by the seller.

A Mandatory Clause on Transfer of Title

The seller should make sure there aren't charges and any dues or burdens before handing over the property. The buyer shall make the seller cover the expenses incurred if there are any dues left over.

Stamp Duty: Registration of Sale Deed

Any unregistered sale deed has no worth in the eyes of the law; therefore, sale deed should be registered in the local sub-registrar office. The importance and price of these papers are the money you want to pay as the stamp duty, and the details must be typed on non-judicial stamp papers.

Sale deed must be registered at the jurisdictional sub-registrar office, which can be mandatory to draft on non-judicial stamp paper.

Non-judicial stamp paper is purchased as per circle rates of state in the country, according to the stamp act of the respective state. An example of a secure understanding; Stamp duty is 6% for a man and 4% for a woman in Delhi. So, the stamp duty is Rs.60, 000 if you're a man and buying a property worth Rupees 10 lakh.

Moreover, for your knowledge, different preferences of e-stamp are obtainable in the states- Karnataka, Delhi, Uttarakhand, Gujarat, Rajasthan, Punjab, Odisha, Tamil Nadu, Jharkhand, Daman & Diu, Himachal Pradesh, Dadra & Nagar Haveli, Assam, Uttar Pradesh, Chhattisgarh, Puducherry, Andhra Pradesh, Jammu & Kashmir, and Chandigarh. One has to fill the form physically in the case of other states.

Book a Free Consultation

Get response within 24 hours

What are the Benefits of a Sale Deed?

It Guards the Parties

A well-drafted sale deed would curtail legal hazards/obstacles and avoid vagueness.

Outlines the Area

You should know the complete details of the property as a buyer, including the location & square foot area.

Legal Enforceability

It is enforceable by the law as a sale deed accomplishes the sale into a legal Document.

Constant and Comfortable

A sale deed reduces troubles as all money due can be detailed in the Document. This enables the process of sale more consistent and comfortable.

Assurance for no Grant

Moreover, it promises that your property is not taken for granted, given the survival of a registered and stamped permissible Document.

There are few disadvantages of sale deed format; those are as follows:-

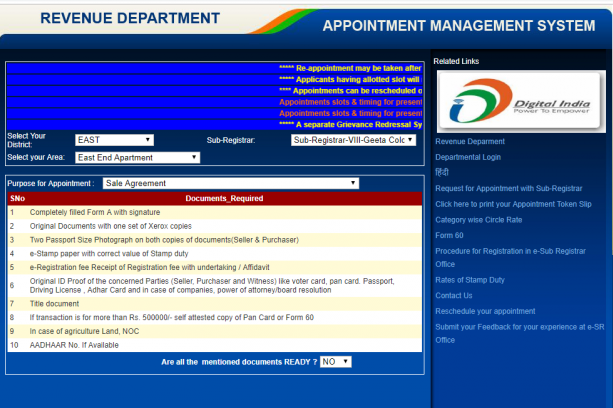

What are the Documents Required for Sale Deed Registration?

You are supposed to mention the following in the papers after the papers are purchased.

Those are as Follows:-

What is the Sale Deed Registration Process?

Note: Both parties are supposed to reach the sub-registrar office with two witnesses. Correspondingly, don't forget to keep your original ID proofs with you and the property registration payment receipt and TDS. An appointment ID is generated after online confirmation, which you must carry with you as proof.

What are the Things to Keep in Mind While Registering?

The Property must not be Under Any Due Liability/Burden.

Financial inconveniences should be checked whether the buyer is making this purchase concerning such encumbrance, or whether there's burden or encumbrance to be precise on the property involved in the agreement. The seller is supposed to pay the loan to get the property's credentials clean of any burden on it, if not so. The purchaser or the buyer must verify from the registrar's office if any existence of such encumbrance over the property is detectable or not.

Before Dispensing the Property by the Owner or Seller, It must Get Noted that All Payments must be Completed on Time.

The seller must already pay all the payments before the execution of Sale Deed. Those may include under a situation like water bills, electricity bills, cess and property tax, and other changes like society maintenance charges, etc.

Mortgage on Property and Connection of Mortgagee for the Duration of Sales Deed

The mortgagee will acquire possession of the Sale Deed agreement in case the property which is under a mortgage as security, concerning getting back the payments over the loan.

CorpBiz Procedure for Sale Deed Registration

CorpBiz recommends you that you should be in contact with a lawyer to understand the requirement in detail. The elementary information would be mandatory from your end to start the process. The lawyers will begin working on your Document once all the information is provided, and the payment is received. Also, you will acquire the first draft of your authorized Document within a few business days. You can evaluate the Document, and you can intimate for the corrections in case of any modifications.

Why us?

CorpBiz will ensure you to execute Legal assistance for legal work over all your compliance works, with the expertise of our team of legal professionals & business advisors by utilizing our tech abilities. Come on board and experience the ease and convenience.

CorpBiz ensures Realistic Expectations, a seamless interactive process with the government through handling all the paperwork. Yes! You are just a phone call away from the finest in legal services.

Frequently Asked Questions

Sale deed evidences the Sale and transfer of ownership of a property, a legal contract executed by the seller & the purchaser. You have to be sure of relevant details while purchasing immovable property, like decided price, any dues associated with it, the total area of the property, and the date of transfer of ownership, etc.

The person who signs on the sales deed admitting to the fact that the buyer and seller have signed the sale deed is known of him, called as a witness.

A duty levied by the government on the legal acknowledgment of certain Documents. It is a kind of property tax while a property is being sold, which desired to be paid to the respective administration.

The Registration fee needs to be paid to acquire the property transferred and registered (additional to the stamp duty charges) in your name.

The title refers to the proper way of ownership of the property (saying you own a right to something), connoting that you have the right to practice that property.

If there is any advance paid Sale price must be agreed between the buyer and the seller and should be mentioned in the sale deed format. The sale deed must include all the information concerning the mode of payment, which may add via Demand draft, cheque, an online transfer is also essential in the case to case basis.

Go to the office or book an online appointment with the sub-registrar. You could also go to the reception of the sub-registrar office for the same.

It guards the parties, Outlines the area, helps in Legal Enforceability, Constant and Comfortable, and assurance for no Grant.

The property must not be under any due liability/burden or financial inconveniences. It should be checked whether buyer is making this purchase concerning such encumbrance, or whether there's burden or encumbrance to be reflected on the property indulge in the agreement.

Before dispensing the property by the owner or seller, it must get noted that all payments must be completed on time. The seller must already pay all the payments before the execution of Sale Deed.

The mortgagee will take possession of the Sale Deed agreement in case the property is under a mortgage as security concerning getting back payments over the loan.

When there is an actual sale of property in a Contract of Sale, it is known as Sale. However, it is called Agreement to sell if there is intention to sell the property when some conditions are satisfied or at a particular time in the future.

A thing that creates difficulty in the transfer of property from one owner to another is known as an encumbrance. It may include outstanding mortgages, property taxes, liens on real estate, unpaid, etc.

You will have to show proof of ownership of the property. However, one can sell ancestral property with no sale deed as one has not acquired but only inherited. Please contact CorpBiz's support to discuss your specific case.

.

.